What You Need to Know

Medicare Supplement plans are designed to pay your costs related to Original Medicare.

Your Medicare Supplement plan is generally only going to cover those services that Medicare covers with the exception of foreign travel.

In order to enroll in a Medigap policy, you must first enroll in Medicare Parts A and B.

Plans are standardized. Once you select your package of benefits, you’ll have predictable costs.

Medicare Supplement plans, also known as Medigap policies, are health insurance policies that limit the amount you’ll pay for medical services once you are on Medicare. As you may know, both Medicare Part A and Part B have deductibles and other costs that you pay and don’t have an out-of-pocket maximum. Because of this, you will want to find a plan that works for you now and into the future. But where do you begin?

What’s Medicare Supplement Insurance?

Let’s start with what a Medicare Supplement plan, also known as a Medigap policy, is and how it helps you. Medicare Supplement or Medigap policies, referred to collectively as Medicare Supplements, are policies sold by private insurance companies to Medicare beneficiaries like you. They are overseen by state insurance departments. Plans are standardized and prices can vary based on where you live.

Medicare Part A and Part B, also known as Original Medicare, have out-of-pocket costs that you pay. Part A has a benefit period hospitalization deductible ($1,632 in 2024) plus daily copayments if you’re hospitalized for more than 60 days. Part B has an annual deductible ($240 in 2024). After the Part B deductible, Medicare pays 80% of the allowed charges.

What’s the Purpose of Medigap?

With Original Medicare, you pay the deductibles, copays, and 20% for services you receive from doctors. Medicare Supplement plans can pay some or all of these costs for you. They “supplement” or fill the “gaps” in Original Medicare. If Medicare doesn’t cover the service, then generally your Medicare Supplement plan doesn’t cover the costs either and you would pay for those services yourself.

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

In general, Medicare plans are individual plans and only cover one person per policy. This is a great advantage since a husband and wife with different needs can have different plans. They are able to pick the plan that is right for them.

What Does Medicare Supplement Cover?

Your Medicare Supplement plan is generally only going to cover those services that Medicare covers with the exception of foreign travel. These are called Medicare-allowed or Medicare-covered charges. Most “medically necessary” services are covered by Medicare and would then be covered by the supplement plan.

Medicare isn’t going to cover experimental services or services that are not medically necessary. The “Medicare & You” handbook sent out annually to Medicare beneficiaries, as well as its website, provides detailed information on covered services. In fact, if you are wondering about a service, a quick search on the website can usually give you the answer.

Medicare Supplement plans stopped covering prescription medications in 2006, although some beneficiaries still have policies that provide this benefit. You will want to purchase a Medicare Part D plan to reduce the costs of your medications. These plans are separate from your Medicare supplement plan.

Guaranteed Renewal

Medicare Supplement plans are “guaranteed renewable” so you can’t be canceled unless you forget to pay your premium.

How Do You Enroll in Medicare Supplement?

In order to enroll in a Medicare Supplement plan, you must first enroll in Medicare Parts A and B. If you only sign up for Medicare Part A when you turn 65, usually because you or your spouse are still working, then you will need to contact the Social Security Administration to enroll in Part B.

It’s important to know that in the first six months of Medicare Part B enrollment, you can purchase a Medicare Supplement plan and not have to worry about preexisting conditions or being accepted. This is called the guaranteed issue right period. Any insurance provider must accept your application.

When Do You Enroll in Medigap?

This Medigap Open Enrollment Period is a one-time enrollment opportunity after you are 65 or older and first enroll in Medicare Part B. If you determine that a Medicare Supplement plan is not right for you now and decide to apply later, you could be turned down for coverage. You would go through a process called underwriting to determine if you are acceptable to the insurance company.

Generally, though, you will want to purchase a Medicare Supplement plan during the one-time Medigap Open Enrollment Period to take advantage of the guaranteed issue. You won’t have to worry later on about qualifying for coverage.

Your Medicare Supplement plan is also guaranteed renewable which means the insurance company cannot drop your coverage as long as you pay your premium on time. This is a great comfort to have knowledge that you’re covered if the worst happens.

How Much Does Medigap Cost?

It is important to know how much a Medicare Supplement plan costs now and consider what it could cost you in the future. Plan prices vary by state so where you live plays a role in how much you pay.

A quick search on medicare.gov revealed plan premiums estimated at $34 (High-Deductbile Plan F) a month in Los Angeles, California, and an estimated $353 (Plan F) a month in West Palm Beach, Florida.

The premium is not only determined by the area where you live but also the plan that you choose. The cheapest plan ($34) will not cover as many of your medical expenses as the most expensive ($353).

Depending on the plan you choose, there may be other costs besides the premium. You may pay copays (a flat dollar amount) or coinsurance (a percentage) of the cost of services. There could also be a deductible you pay before the insurance begins to cover your medical expenses.

Let’s look at your plan options. In most of the United States, plan designs are standardized. However, Minnesota, Wisconsin, and Massachusetts have their own method of standardization. For detailed information on the options in these states, go to Medicare.gov and search “Medigap in [State]” to learn more.

What Are the 10 Medicare Supplement Plans?

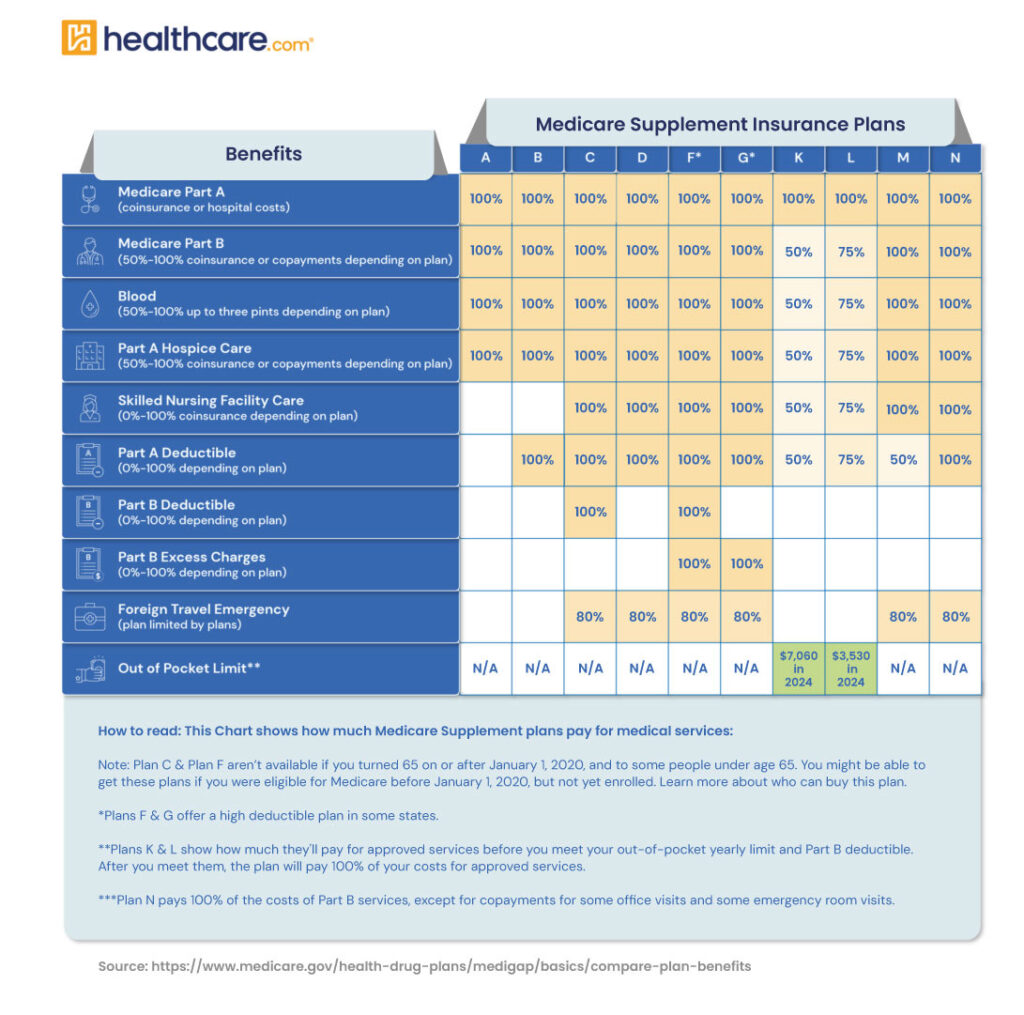

We’ll look at standardized plans in the other 47 states. You can see from the table below there are many options available.

The chart below shows basic information about the different benefits Medigap policies cover.

It’s important to understand what your plan covers. There is more to consider than just the monthly premium. You’ll also want to know:

- What are your out-of-pocket costs?

- How much can you expect premiums to go up each year, on average?

- What is your long-term health outlook?

When you look at the chart above, you can see that some plans cover just about everything — Plan F, the most popular Medicare Supplement plan, covers all Medicare allowed services except for 20% of foreign travel. You can expect to pay more in premium for these plans which will limit what you will pay for medical services.

Why Choose Medicare Supplement Plans?

When it’s time to pick a plan, you may wonder why you would choose a Medigap policy over other less expensive options. Medicare Supplement plans offer the following advantages:

- Coverage is nationwide. If you are traveling in the United States, as long as you go to a medical provider that accepts Original Medicare (Medicare parts A and B), you are covered by your plan.

- Costs are predictable. If you are eligible for and choose Plan F, you’ll pay the monthly premium and usually nothing else for medical expenses. Other plans offer you similar, predictable out-of-pocket costs.

- You don’t need a referral to see a specialist. As long as the specialist accepts Medicare, you are covered.

- Medicare Supplement plans are “guaranteed renewable” so you can’t be canceled unless you forget to pay your premium. Otherwise, it will stay in place with adjustments to the premium each year after year.

- Plans are standardized. Once you select your package of benefits (a lettered plan), you’ll have predictable costs.

If you have one or more chronic medical conditions, a Medicare Supplement plan may be the best option to keep your costs manageable. Depending on your resources, you could choose a less expensive plan with some out-of-pocket costs.

How to Pick Medicare Supplement?

You’ve decided you want a Medicare Supplement plan and now it’s time to pick one. You will want to consider your current health and future health when choosing. You should consider family history as well as your own health since certain conditions are hereditary and could play a role in your future needs.

Then it’s all about the math. Insurance of any kind always boils down to math – how much does it cost per month plus how much could you expect to pay out of pocket. You’ll want to compare those numbers to see what is a comfortable fit for you and your budget.

What Are the Most Popular Medicare Supplement Plans?

According to KFF, Plans F, G and N have the highest enrollment. Plan G was the most popular Medigap plan in 2023, covering 39% of policyholders.

Plans G and N over the four-year period in the report are the fastest-growing plan options. With changes to Medicare effective January 1, 2020, Plan F is not available for newly eligible Medicare beneficiaries.

Next Steps

The good news about Medicare is that you have a lot of plan options to choose from. The bad news is that picking the right plan can be challenging because of the variety of options available. It is worth taking some time to compare plan options and insurance companies that offer coverage where you live.

With standardized plans, it makes the comparison a little easier. Consider insurance companies’ premiums for the same plan to find a winner. Do the math before you decide. Sometimes, paying a little less in premium while you’re healthy can provide savings for future years when you might need more services.

Seek the advice of an independent Medicare specialist in your area that can help you get rates for various plans and compare companies. They will also know which companies are easier to work with than others, something good to know before you decide!