Written by Leonie Dennis

HealthCare Writer

Reviewed by Diane Omdahl

Expert Reviewer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

Many people find out about their Medigap Open Enrollment Period when it’s too late. If you’re new to Medicare, make sure you understand the best time to get a Medicare Supplement plan.

Getting Medicare for the First Time?

Your Medigap Open Enrollment Period is separate from your Initial Enrollment Period when you first qualify for Medicare.

When you sign up for Medicare with Social Security or get automatically enrolled, you will not have a Medicare Supplement plan. What you’ll have is Original Medicare, or Medicare Part A (covering mainly hospital costs) and Part B (covering mainly preventive services and outpatient care). This is the traditional health insurance program that’s run by the federal government.

Once you have Part A and B, you can get a Medicare Supplement plan.

Tip: Be careful not to confuse your Medigap Open Enrollment Period, sometimes referred to as the Medicare Supplement Open Enrollment Period, with the Annual Enrollment Period (also known as the fall Open Enrollment Period) that runs from October 15 to December 7 each year. The Annual Enrollment Period allows you to make changes to your Medicare coverage, such as switching between Original Medicare and Medicare Advantage.

Compare options HERE & start your health plan journey.

What is a Medicare Supplement Plan or Medigap Policy?

Medicare Supplement, or Medigap, is an optional health insurance plan that works with Original Medicare (Parts A and B). Only private insurance companies sell Medigap policies. You pay a monthly premium to the company, and in exchange, your policy covers some to all of your Parts A and B out-of-pocket expenses after Medicare pays its portion.* Once you pick the benefits you want, a policy, no matter which company sponsors it, must provide them, but prices can vary among companies.

Medigap policies:

- Help pay for out-of-pocket costs Original Medicare doesn’t cover, such as deductibles, coinsurance, and copayments

- May provide coverage for qualifying emergency care you receive in a foreign country (not all plans offer this benefit)

- Provide nationwide coverage at any provider that accepts Medicare

- Only cover one person — your spouse can’t enroll on the same plan

- Are guaranteed renewable as long as you pay your monthly premiums on time

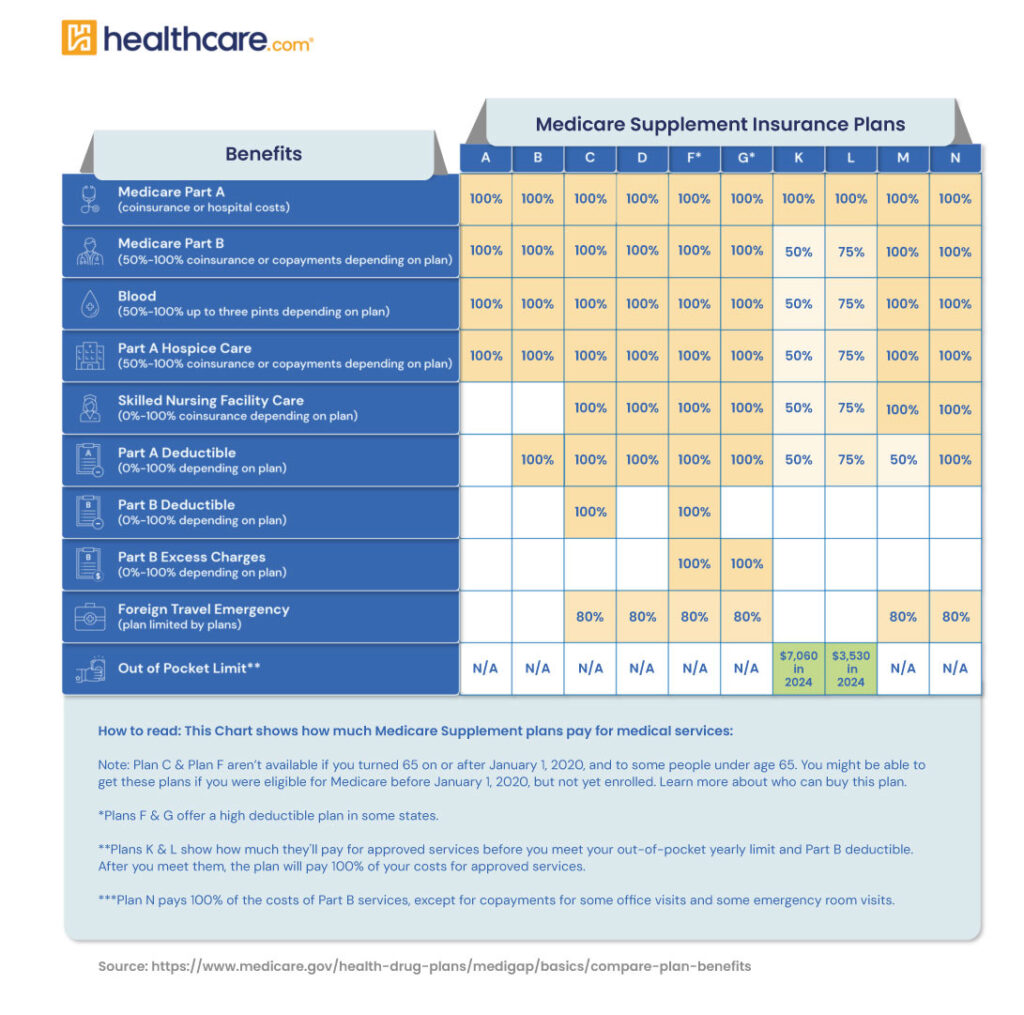

- Come in 10 standard types in most states, which are labeled by letters: A, B, C, D, F, G, K, L, M, N**

- Each plan covers a portion of certain costs. For example, most plans pay 100% of your Part A deductible ($1,556 for each benefit period in 2022).

*You must pay your Medicare Part B premium in addition to your Medigap premium. Plans C and F are not available to newly-eligible beneficiaries on or after January 1, 2020. **Medigap plans are standardized differently in Massachusetts, Minnesota, and Wisconsin.

(See the Medigap policy comparison chart below.)

When Should You Enroll in a Medicare Supplement Plan (Medigap Policy)?

The month you are both 65 and enrolled in Part B begins your Medigap Open Enrollment Period (OEP).

This is the best time to apply for a policy because you won’t have to answer any medical questions to qualify (a process called medical underwriting). So no matter your health status, insurance carriers cannot deny you a policy during your Medigap OEP. Plus, you can buy any plan that’s sold in your state at the cheapest price available.

But here’s the catch: Your Medigap Open Enrollment Period is generally a one-time event, and it only lasts for six months. If you turn 65 and enroll in Part B on July 1, for instance, your enrollment period will end on December 31. Once this period begins, it can’t be delayed or changed.

If you live in Connecticut, Massachusetts, Maine, or New York, you may have specific annual enrollment dates or year-round open enrollment when you can buy a policy without answering any medical questions.

What If You Miss Your Medigap Open Enrollment?

Insurance companies can use medical underwriting to qualify you for a policy outside of your open enrollment. They can charge you more based on your health, and even deny your application. However, you’re exempt from these rules if you have a guaranteed issue right to buy Medigap. We’ll talk more about these rights later.

Can You Get a Medigap Policy Under 65?

Depending on the state, you may be able to apply when first eligible and get a policy. But the premiums you pay may be more. Then as you get closer to 65, you can enroll in a Medigap policy of your choice at the best price during the Initial Enrollment Period. The IEP begins three months before you turn 65.

When Can You Enroll in Medigap Outside of Your Medigap Open Enrollment Period (OEP)?

You’re free to apply for a Medigap policy whenever you want. But you run the risk of paying more or being denied coverage when you apply outside of your Medigap OEP. However, there are some instances when you can apply past your OEP and still get a policy without facing those risks. This is called guaranteed issue rights. Let’s look at these rights below.

When Do You Have Guaranteed Issue Rights to Buy a Medigap Policy Outside of Your OEP?

You usually have guaranteed issue rights when you have other coverage that changes in some way. For example, your insurance company stops offering coverage where you live. During this time, insurance companies must sell you a policy, cover all your preexisting conditions. In most cases, you have 63 days from the date your coverage ends to enroll in a Medigap policy.

Here are some of the most common situations for Medigap guaranteed issue rights.

- You have Original Medicare and group coverage through COBRA, an employer, or a union plan that pays after Medicare pays its portion, and that plan is ending.

- You’re enrolled in Medicare Advantage and the plan stops offering coverage where you live, you move out of the plan’s service area, or the plan leaves Medicare.

- You enrolled in Medicare Advantage when you were first eligible for Medicare at age 65, you’re still within your first year of enrollment, and you want to switch back to Original Medicare.

- You left your Medigap policy to join Medicare Advantage for the first time, you’re in your first year of enrollment, and you want to switch back to Medigap.

What If You Continued Working Past 65?

If you’re still working past 65 and you or your spouse get health insurance through an employer or union with 20 or more employees or members, you may already have coverage that’s similar to Part B. In this case, you can postpone Part B enrollment and you won’t face a penalty when you enroll later.

Your Medigap Open Enrollment Period will start once you sign up for Part B. You’ll have six months to buy any plan sold in your state at the lowest possible rate with no medical questions asked.

What If You Can’t Enroll in a Medigap Policy?

If you don’t qualify for a Medigap policy, you’ll have to pay all your Original Medicare out-of-pocket expenses yourself. Because Original Medicare doesn’t have a cap on those expenses, your out-of-pocket costs can add up pretty quickly.

Here’s an example:

| Without Medigap | With Medigap |

| Carl has outpatient surgery. His total Medicare-approved bill under Part B is $10,000 Carl is responsible for a 20% coinsurance, which amounts to $2,000 out-of-pocket |

Carl has a Medigap policy that pays 100% of his Part B coinsurance after meeting the Part deductible. Carl’s Medigap policy pays the $2,000 coinsurance directly to his doctor, leaving Carl with $0 out-of-pocket |

Can’t Get a Medigap Policy? Try Medicare Advantage

If no insurer will sell you a Medigap policy, you have an option. Medicare Advantage is another private health plan that can save you money. Plans have a maximum limit on out-of-pocket costs, typically $5,000. Some plans even have no monthly premium.

Medicare Advantage plans provide Part A and Part B, and often include Part D prescription drug coverage. You can have either a Medigap policy or Medicare Advantage plan, not both.

Now that you know when you can enroll in a Medicare Supplement plan and the types of plans available, you’re better prepared to sign up. Remember that your Medigap Open Enrollment Period is a one-time event that’s unique to you, so don’t miss it!

Medigap Policy Comparison Chart

Let’s review the different types of Medigap plans and what they cover. “Yes” means the plan covers that benefit at 100%.

Shop for a Medicare plan with additional benefits!

Thank you for your feedback!

U.S. Government Website for Medicare. “Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare.” medicare.gov (accessed May 11, 2020).

“Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare.”

U.S. Government Website for Medicare. “Medicare Costs at a Glance.” medicare.gov (accessed November 30, 2021).

U.S. Government Website for Medicare. “When Can I Buy Medigap?” medicare.gov (accessed May 14, 2020).

Kaiser Family Foundation. “Medigap Enrollment and Consumer Protections Vary Across States.” kff.org (accessed May 14, 2020).

“Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare.”

“Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare.”

U.S. Government Website for Medicare. “How Original Medicare Works.” medicare.gov (accessed May 20, 2020).

“Choosing a Medigap Policy: A Guide to Health Insurance for People With Medicare.”

by

Diane Omdahl |

Updated on

October 28, 2025

by

Diane Omdahl |

Updated on

October 28, 2025