Written by Jennifer Nelson

Reviewed by Diane Omdahl

Expert Reviewer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

What You Need to Know

- Plan F is the most comprehensive plan. It covers one more benefit than Plan G.

- According to KFF, Plan G was the most popular in 2023, covering 39% of policyholders (5.3 million people). Plan G typically has higher premiums than Plan N because it includes more coverage.

- You could save money with Plan N because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G.

Medicare Supplement Plans F, G, and N can help bridge the gaps in Medicare coverage. If you’re approaching age 65 and wondering about your choices in Medicare and a Medigap policy, we’re here to help break down some important information for you.

First up, Medicare Parts A and B are Original Medicare. This is available to everyone 65 or over, people with disabilities, or those of any age with end-stage renal disease and Lou Gehrig’s disease (ALS). Part A covers hospitalizations, home health, hospice, and skilled nursing care. Part B covers outpatient and preventive care like doctor’s visits and X-rays.

Medicare Supplement plans, also known as Medigap policies, help cover costs excluded from Original Medicare. You must have Parts A and B if you want to buy Medicare Supplement Plans F, G, or N. As of 2017, roughly 40-50% of Medicare beneficiaries purchased a Medigap policy.

What is a Medigap Policy? What Does it Cover?

Medigap policies, which supplement Original Medicare, are sold by private health insurance companies. While Original Medicare covers most things, there are out-of-pocket costs like deductibles, copayments, and coinsurance. Those gaps can be covered by purchasing Medicare Supplement Plans F, G, or N. These policies are standardized across states, meaning they all must provide roughly the same coverage no matter which state you live in.

In Massachusetts, Minnesota, and Wisconsin, however, Medigap policies are standardized differently, meaning they package the coverage in slightly different ways in those states.

Typically, Medigap policies won’t cover long-term care, vision, dental, eyeglasses or private nursing care.

What’s more, some carriers are adding perks to their plans such as deeply discounted health club or fitness center memberships.

Quick Overview

Plan G provides more coverage than Plan N, but Plan N could save you money on lower premiums. Plan F is the most comprehensive option but it’s not available to everyone.

When Should You Enroll in a Medigap Policy?

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. During those six months, private insurers cannot deny you an available policy for any reason, and you have more options and lower pricing. You may also have other options for purchasing a Medigap policy later, depending on your situation. For example, a canceled policy, a loss of insurance, an insurance carrier bankruptcy, and other circumstances may qualify.

But outside of open enrollment, insurers can use medical underwriting – things like your age, gender, area of the country, and previous health conditions – when deciding to sell a policy. That means you may be denied a policy or have to wait for preexisting condition coverage, often for six months after your policy is in effect, pay higher premiums, or have fewer options than when enrolling during the open enrollment period.

Your state may have additional rules regarding open enrollment so check to be sure.

Compare plans by type.

How Should You Shop and Compare Medicare Supplement Plans?

Comparing plans is important. Here are some key points to remember as you do so:

- Find out which insurers sell Medigap policies in your state.

- Narrow down the benefits you’d like to have in a policy.

- Compare policies to see which one meets your needs and look for any extra perks.

- Be aware that different insurers may charge different amounts for the exact same Medigap policy.

- Not all insurers offer all the available Medigap policies.

- Compare costs apples to apples, such as a Medicare Supplement Plan G with a Medicare Supplement Plan G at different insurance carriers.

- Choose carefully because you may not be able to switch Medigap policies later.

How to Choose Between Medicare Supplement Plans, F, G, and N

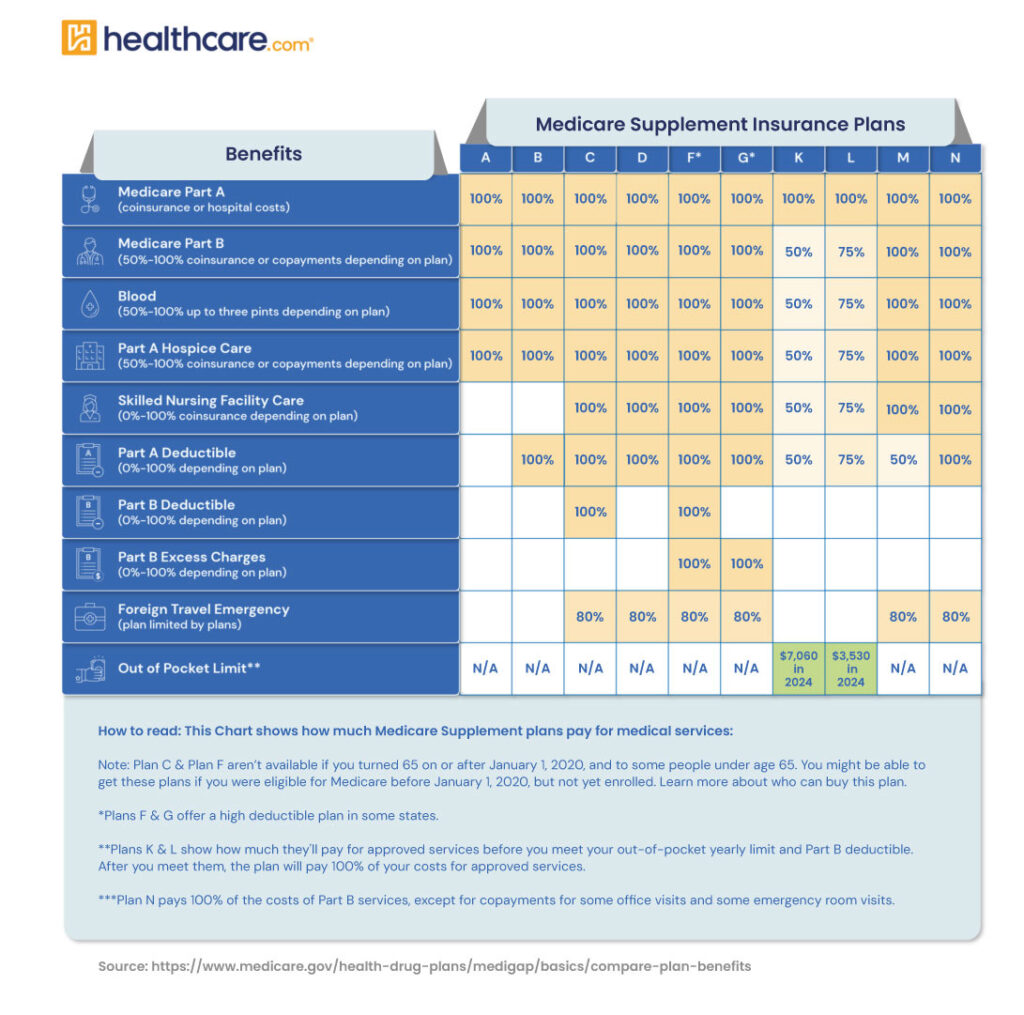

Medicare Supplement Plans F, G, and N include similar benefits with a few differences. To select a policy, find the benefits that are most important to you, and select the policy that matches your needs most closely. Use the chart below to help compare.

Medicare Supplement Plans

- Plan F, which covers Medicare Part B deductible, is not available to those newly eligible for Medicare on or after January 1, 2020. However, if you already have Plan F or its high-deductible version, you can keep it.

- Plans F and G offer a high-deductible option, though not every carrier offers them. You’ll pay Medicare coinsurance, copays, and deductibles out-of-pocket before your coverage begins.

- Neither Plan G nor Plan N covers the Part B deductible.

- Plan N will pay 100% of the Part B coinsurance, except for copays of up to $20 for certain office visits and up to $50 for emergency room visits when you’re not admitted to the hospital.

- Medicare Supplement Plan F is the most comprehensive plan. Plan F covers one more benefit than Plan G, which is the Part B deductible. Plan G and Plan N premiums are lower to reflect that.

- Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

- Costs of Medigap policies vary by state and carrier.

Next Steps

Finding the best Medicare Supplement can be challenging, complex, and confusing. Plan G may provide more coverage while Plan N could save you money on lower premiums. Plan F is the most comprehensive plan but as of January 1, 2020, won’t be an option if you’re a newly eligible beneficiary. For more information, talk with a broker or insurance carrier in your state.

Thank you for your feedback!

Centers for Medicare and Medicaid Services. “2020 Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.” cms.gov (accessed June 2, 2020).

Moeller, Phillip. “Standard Medigap Plans are Learning Some New Tricks.” pbs.org, September 13, 2017 (accessed June 4, 2020).

“2020 Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.”

Moeller, Phillip. “Standard Medigap Plans are Learning Some New Tricks.”

“2020 Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.”

U.S. Government Website for Medicare. “Medicare Costs at a Glance.” medicare.gov. (accessed June 18, 2020).

“2020 Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.”

“2020 Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.”

by

Diane Omdahl |

Updated on

August 29, 2025

by

Diane Omdahl |

Updated on

August 29, 2025