What You Need to Know

Original Medicare helps to cover many healthcare expenses, but you’ll still need to pay for copayments and deductibles. A Medigap policy can help to cover these fees.

You’ll need to be enrolled in Medicare Parts A and B to qualify for a Medigap plan.

In Tennessee, you can choose from 12 policies, including two high-deductible options.

Medigap policies can help Tennessee residents control out-of-pocket Medicare costs.

Original Medicare — which is Medicare Part A and Part B combined — covers many of your healthcare expenses, but you’ll still be responsible for fees like copayments and deductibles, which can quickly add up.

A Medigap policy, also called a Medicare Supplement plan, can help to minimize or eliminate those out-of-pocket costs. Your Original Medicare will contribute toward your healthcare expenses, then your Medigap policy will help to cover some or all of your remaining fees.

When Can You Enroll in Medigap in Tennessee?

Medigap has a six-month Open Enrollment Period, and it’s easiest to apply for a policy during this time.1

Your Open Enrollment Period will automatically start the month that you turn 65 and enroll in Medicare Part B. During Open Enrollment, you can buy any plan, even if you have a preexisting health condition like COPD. You can also change policies if you need to do so.

It’s still possible to enroll in Medigap outside of Open Enrollment, but the process gets more complicated.

Once your Open Enrollment Period has ended, an insurance provider can increase the cost of your plan or even deny you coverage for a preexisting condition. That provider might decide to implement a six-month waiting period before your coverage takes effect, and it might exclude your preexisting condition.

There are a few instances where you can enroll in a policy outside of Open Enrollment without facing these restrictions.

Some situations, like moving outside of your current Medicare Advantage Plan’s service area, can qualify you for guaranteed issue rights.2 With guaranteed issue rights, an insurance provider must let you buy a Medigap policy even outside of Open Enrollment.

The provider won’t be able to increase your policy cost or exclude a preexisting condition. However, these are very specific situations, so look closely at the restrictions.

Alternatively, you might qualify for a Special Enrollment Period if you’ve experienced a qualifying event like moving or losing your current coverage.3 You can make changes to your coverage during a Special Enrollment Period, though the type of your qualifying event will determine the types of changes you can make.

Looking to Change?

Outside of your Open Enrollment Period, it can be difficult to change your Medigap policy unless your reason for switching falls under guaranteed issue rights or you qualify for a Special Enrollment Period.

What Are the Most Popular Medicare Supplement Plans in Tennessee?

In Tennessee, 315,000 residents have purchased Medigap policies. The most popular are Plans F, G and N.4

| Plan Type | Total Enrolled (Rounded) | % of Total Enrolled |

| Plan F | 157,000 | 50% |

| Plan G | 95,000 | 30% |

| Plan F | 21,000 | 7% |

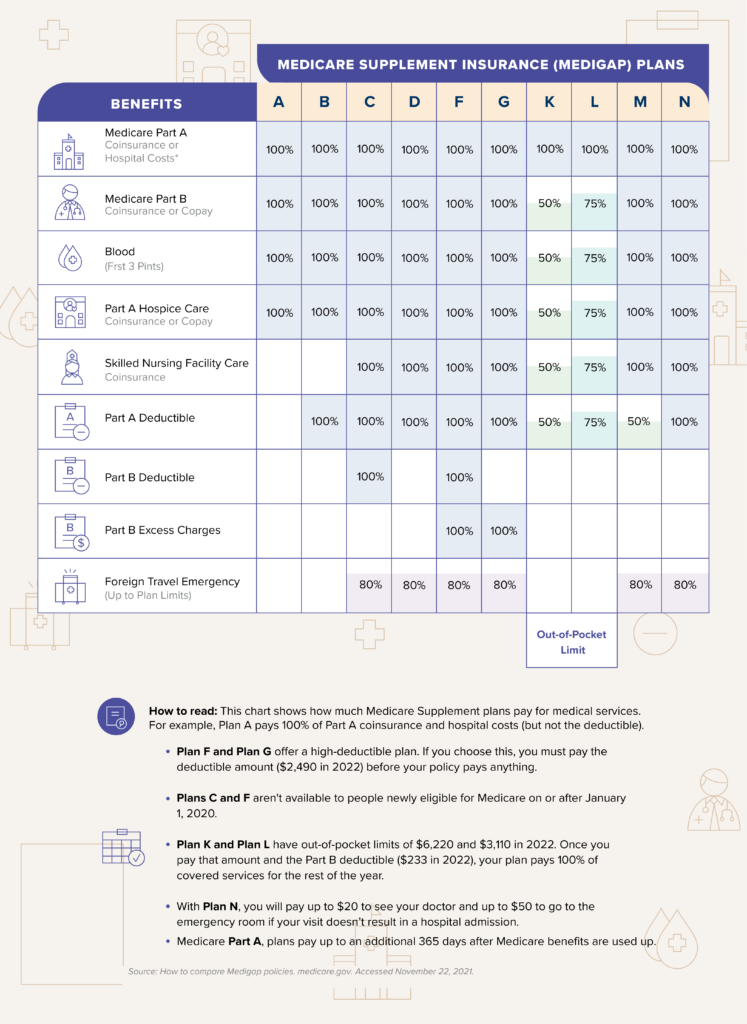

You have 10 Medicare supplement plans and two high-deductible options to choose from.

Each plan’s coverage, premium, deductible, and copayments can vary, so it’s good to carefully research each plan to understand what’s included.

Note: Plans C and F are not available to anyone who qualified for Medicare after January 1, 2020.

Plan F

Plan F is the most comprehensive policy, which covers:

- Part A coinsurance and hospital costs

- Part B copays/coinsurance

- Blood (first 3 pints)

- Part A hospice

- Skilled nursing facility

- Part A deductible

- Part B deductible

- Part B excess charges

- Foreign travel emergency – 80%

Plan G

Plan G offers similar coverage as Plan F, excluding for the Part B deductible ($233 in 2022):

- Part A coinsurance and hospital costs

- Part B copays/coinsurance

- Blood (first 3 pints)

- Part A hospice

- Skilled nursing facility

- Part A deductible

- Part B excess charges

- Foreign travel emergency – 80%

Plan N

Plan N offers similar coverage as Plan G, but it excludes the Part B deductible and Part B excess charges:

- Part A coinsurance and hospital costs

- Part B copays/coinsurance

- Blood (first 3 pints)

- Part A hospice

- Skilled nursing facility

- Part A deductible

- Foreign travel emergency – 80%

Snippet Render Is Present – D3 cannot be loaded in editor mode. Go to preview or publish mode.

How to Choose a Medicare Supplement Plan in Tennessee

Medicare policies offer different coverage, and certain plans will be a better fit depending on the types of healthcare costs that you most frequently face. By choosing one that covers your most common expenses, you’ll get the best value. As you compare the different policies, look for a plan that balances good coverage with a premium that you can reasonably afford.

A Word of Advice

The cheapest premium doesn’t necessarily mean the best Medigap plan for you. Consider the coverage you currently need and what you might need in the future as well when selecting a policy.

How Much Do Medigap Policies Cost in Tennessee?

Medigap plans vary in both cost and coverage. Different policies also carry different deductibles and copayments. The following costs are for a 65-year-old female in Tennessee who doesn’t use tobacco, and they can give you a rough idea of plan premium costs:

- Plan F: $100 to $371

- Plan F High-Deductible: $22 to $72

- Plan G: $95 to $341

- Plan G High-Deductible: $22 to $69

- Plan N: $62 to $315

Source: Medicare.gov cost calculator

Who Sells Medigap Policies in Tennessee?

You can buy Medigap policies from six companies in 2021.

- Colonial Penn Life Insurance Company

- Transamerica

- United American Insurance Company

- United States Fire Insurance Company

- Wisconsin Physicians Service Insurance Corporation

- UnitedHealthcare

What If You Want to Change Your Medigap Policy in Tennessee?

As discussed earlier, it’s easy to change your Medigap policy during your Open Enrollment Period. But once that period has ended, you’ll have limited opportunities to change your plan.5 If you have guaranteed issue rights or a Special Enrollment Period, you can change your policy, but keep in mind that the types of changes you can make may be limited. Instead, it’s best to carefully research each available plan during your Open Enrollment Period. Choosing the best one for your needs from the start will mean you won’t have to worry about making changes later.

What Are Alternatives to Medicare Supplement in Tennessee ?

If you don’t feel that Medigap is right for you, you might want to consider a Medicare Advantage plan. Medicare Advantage plans work similarly to Medigap policies, helping to cover the Medicare Part A and Part B expenses you’re responsible for.6 Some plans even offer prescription coverage, which Medigap policies don’t provide.

What Are Medicare Resources in Tennessee?

- The Tennessee State Health Insurance Assistance Program (SHIP) offers free one-on-one counseling and information to help you choose and enroll in a Medicare plan.

- The Tennessee Department of Commerce & Insurance’s Insurance Division can help you resolve issues and complaints against your insurance provider. This department also offers information about available insurance options.

- TennCare Medicaid, Tennessee’s Medicaid program, provides information on Medicaid eligibility and how to apply.

Next Steps

Medicare covers many of your healthcare expenses — but remaining costs, like copayments and deductibles, can add up. A Medigap plan can help to reduce or eliminate those out-of-pocket fees. To learn more, check out How to Choose a Medicare Supplement Plan.