What Are Medicare Supplement Plans in Kansas?

What You Need to Know

Medicare Supplement plans help Kansans with out-of-pocket healthcare costs.

The most popular Medigap policies are Plans F, G and N.

Senior Health Insurance Counseling for Kansas (SHICK) offers free counseling on Medicare and related health insurance to Kansans.

Medicare is a helpful source of health insurance for people age 65 and older. It also helps younger individuals with disabilities and certain health conditions like end-stage renal disease (ESRD).

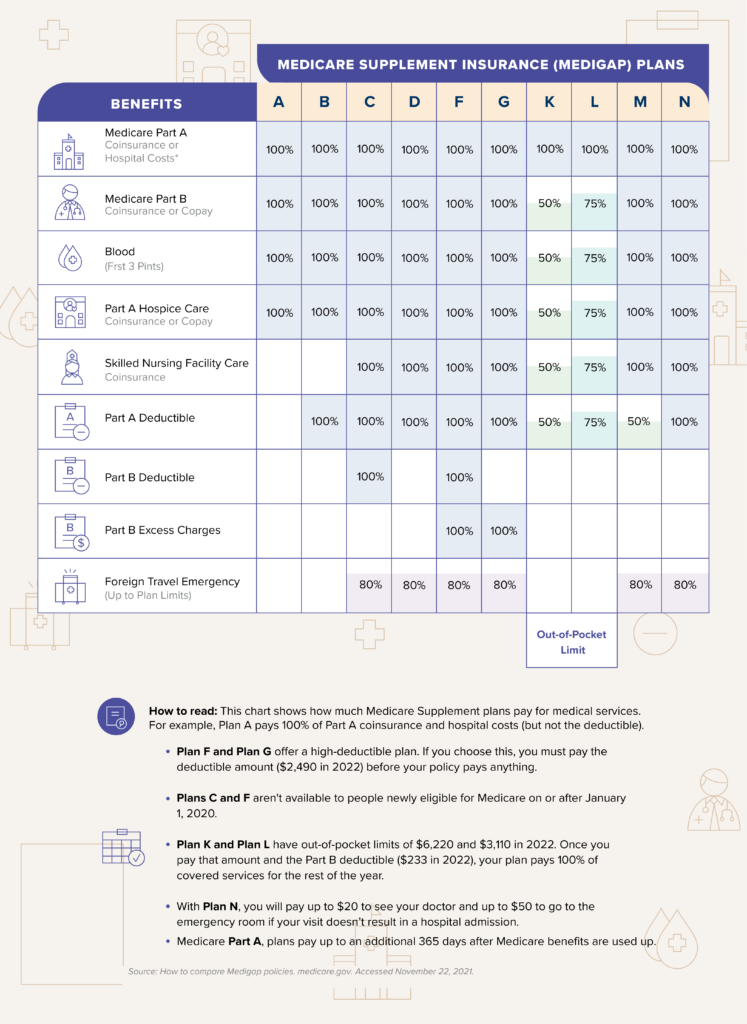

On its own, Medicare coverage has significant out-of-pocket costs, including deductibles, copayments and coinsurance. Kansas Medicare Supplement plans, also known as Medigap policies, help to cover those costs.

Private insurance companies sell these plans, which are standardized by letter (A-N). Learn more about these plans and how they help Kansas residents with their healthcare costs.1

When Can You Enroll in a Medigap Policy?

You can apply for a Medicare Supplement plan at any time. However, insurance companies are allowed to deny your application or charge you more based on any health problems they discover during a process called medical underwriting.

That’s why it’s best to apply during your Medigap Open Enrollment Period, when insurance companies can’t deny your application or charge you more.

This is a six-month period that starts the month you are 65 or older and also enrolled in Medicare Part B. During this period, you can enroll in any Medigap policy in Kansas.2

If you have something called guaranteed issue rights, you are also allowed to enroll in a Medicare Supplement Insurance plan without penalty. You typically have these rights if you’ve lost coverage through no fault of your own — for example, if you have Medicare and an employer health plan, and your employer health plan ends. You also have these rights if you move out of a Medicare Advantage plan’s service area.3

The Best Time to Enroll

You won’t pay a penalty if you buy a Medicare Supplement plan during your Open Enrollment Period, a six-month window when you are 65 or over and have enrolled in Medicare Part B.

What Are the Most Popular Medicare Supplement Plans?

| Plan Type | Total Enrolled (Rounded) | Percent of Total Enrolled |

| Plan F | 147,000 | 58% |

| Plan G | 70,000 | 28% |

| Plan N | 15,000 | 6% |

The most popular Medicare Supplement plans are Plans F, G and N.

Medicare Supplement Plan F is the most popular option because it offers the most coverage. It covers:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayments

- The first three pints of blood

- Medicare Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Medicare Part A deductible

- Medicare Part B deductible

- Medicare Part B excess charges

- Up to 80% of foreign travel emergency costs up to plan limits

Some healthcare providers don’t accept Medicare assignment, which is the amount Medicare pays for a service. Those providers can charge you up to 15% more than the Medicare-approved amount for your service.5 These fees are known as Part B excess charges.

If you started Medicare on or after January 1, 2020, you’re no longer able to purchase Plan F. Fortunately, you can buy Plan G or Plan N.

Plan G covers everything Plan F does except for the Medicare Part B deductible.

Plan N covers everything Plan F does except for the Part B deductible and Part B excess charges. This plan also has copays for certain services. You may have to pay up to $50 for emergency room visits that don’t result in an inpatient admission. You may also have to pay up to $20 for office visits.6

Comparison Shop

Be sure to look at Medigap policies from several different insurance providers since prices for the same standardized plan — say, plan G — will vary from company to company.

How Do You Choose a Medicare Supplement Plan?

The first step in choosing a Medigap policy is deciding which lettered plan(s) you prefer. Next, use the Medicare Plan Finder to find insurance companies approved to sell Medicare Supplement plans in Kansas. Contact multiple insurance companies to compare plan prices.

Be sure to compare plans that have the same letter. For example, compare Plan G prices from one company to Plan G prices from another. Plans with the same letter will have the same benefits, regardless of which company you purchase one from, but prices will vary.

The reason for this is that insurance companies can choose among three pricing methods for their Medicare Supplement plans:

- Community ratings: With this option, insurance companies charge the same premium to everyone, regardless of their age or gender. Companies may increase your rate due to inflation, but not due to age.

- Issue age ratings: With this pricing method, companies base your premium on your age when you buy the policy. This means prices are lower if you purchase the policy when you’re young. Insurance companies may raise prices because of inflation and other factors, but not because of your age.

- Attained age ratings: With this option, the premium is based on your current age. These policies are typically the cheapest when you’re younger and become the most expensive as you age. Insurance companies may also raise premiums due to inflation and other factors.7

Do Medicare Supplement Plans Cover Prescription Drugs?

Medigap policies do not provide prescription drug coverage. Consider buying a Medicare Part D plan if you need a prescription drug plan. Medicare-approved private insurance companies sell these plans.8

How Much Do Medigap Policies Cost?

In Kansas, Medicare Supplement costs vary depending on your age, tobacco use and gender.

65-Year-Old Woman, No Tobacco Use

| Plan Type | Premium Range |

| Plan F | $124-$423 |

| Plan G | $105-$384 |

| Plan N | $82-$347 |

65-Year-Old Man, No Tobacco Use

| Plan Type | Premium Range |

| Plan F | $142-$423 |

| Plan G | $121-$384 |

| Plan N | $92-$347 |

What Companies Sell Medigap in Kansas?

What If You Want to Change Your Medigap Policy?

You can apply for a new Medicare Supplement plan at any time. Keep in mind that insurance companies can use medical underwriting to decide whether to accept your application or they can charge you more unless you’re in your Medigap Open Enrollment Period or you have guaranteed issue rights.

What Are Alternatives to a Medicare Supplement Plan?

Medicare Advantage plans (MA plans) are an alternative to Medicare Supplement plans. These plans are bundled alternatives to Original Medicare. Also known as Medicare Part C, they provide your Medicare Part A and B benefits and may offer additional benefits, such as vision and hearing care. Most of these plans also include Medicare Part D benefits.9

What Are Medicare Resources in Kansas?

Kansans have access to several Medicare resources, including:

- Senior Health Insurance Counseling for Kansas (SHICK): SHICK offers free counseling on Medicare and related health insurance to Kansans. Call SHICK at 1-800-860-5260.

- Kansas Insurance Department: This department handles complaints related to insurance. File a complaint online or by mail.

- KanCare: This is the Kansas Medicaid program. It provides free and low-cost healthcare to people with limited income and assets. Check your eligibility and apply online.

Snippet Render Is Present – D3 cannot be loaded in editor mode. Go to preview or publish mode.

Next Steps

Are you ready to get started with a Medicare Supplement plan? Contact multiple insurance companies to find the one that’s the best fit for your needs and your budget. Keep in mind that you also have to pay the Medicare Part B premium. If you need assistance, SHICK can provide you with one-on-one advice.