Are you eligible for Medicare? If you’re not sure, or you want to learn how to enroll, you’ve come to the right place.

What You Need to Know

Generally, you qualify for Medicare once you turn 65 and are a U.S. citizen or permanent resident.

You may be eligible for Medicare before age 65 if you have a disability or certain illnesses

How much you pay for Medicare depends on how much you paid in taxes while working and your household income.

Are you eligible for Medicare? If you’re not sure, or you want to learn how to enroll, you’ve come to the right place.

Who Is Eligible for Medicare?

Myth

Everyone qualifies for Medicare.

Truth

You must meet certain requirements to get Medicare benefits.

You must be a United States citizen or a permanent resident for five or more consecutive years, and you must meet the age requirement. If you don’t meet the age requirement, you could still get benefits if you have a disability or a serious medical condition like kidney failure.1

When Can You Enroll in Medicare?

Myth

You can enroll in Medicare at any time.

Truth

Generally, you’re eligible to enroll in Medicare once you turn 65 and you enter your Initial Enrollment Period.

Your initial enrollment is a seven-month period:

- It begins three months before the month you turn 65 and ends three months after you turn 65.

- For example, if you turn 65 in September, you can apply for Medicare from June through December.2

What Happens When You Turn 65?

- If you already receive benefits from Social Security or the Railroad Retirement Board (RRB), you’ll be automatically enrolled in traditional Medicare, aka Original Medicare. This consists of Part A hospital insurance and Part B medical insurance. Your Medicare coverage usually starts the first day of the month you turn 65. You should expect to receive your Medicare card in the mail three months before your 65th birthday.

- If you don’t receive Social Security or RRB benefits, you’ll need to enroll. You can sign up for Medicare with Social Security online, over the phone, or in person. You should enroll as soon as your Medicare eligibility period begins, even if you’re not ready to receive Social Security retirement benefits.3

- If you don’t have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65. But if you’re still working and you have health insurance through an employer or union, you may not have to enroll in Part B. We talk more about delaying Part B enrollment below.

Can You Enroll in Medicare Before You Turn 65?

You may be eligible for Medicare before age 65 if:

- You’ve received Social Security Disability Insurance (SSDI) for at least 24 months

- You’ll get Medicare Part A and Part B automatically starting the first day of your 25th disability month. You should get your Medicare card in the mail three months before this date.

- You have Amyotrophic Lateral Sclerosis (ALS), or Lou Gehrig’s disease

- You’ll get Part A and Part B automatically in the month your SSDI benefits begin.

Note: Part B isn’t automatic if you live in Puerto Rico.4 You’ll have to contact Social Security to enroll.

- You have permanent kidney failure, or end-stage renal disease (ESRD)

- You’ll need to sign up for Medicare yourself. Your coverage usually starts the first day of the fourth month of dialysis treatment or in the month you’re admitted to a Medicare-certified hospital for a kidney transplant.5

A Word of Advice

If you don’t have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65.

Who Is Eligible for Medicare Part A?

You qualify for Medicare Part A if you:

- Meet the U.S. citizenship or permanent residency requirements and

- You’re 65 or older, or

- You’re under 65 and get

- Disability benefits from Social Security for at least 24 months, or

- Disability benefits because you have ALS (Lou Gehrig’s disease), or

- Treatment as a kidney dialysis or kidney transplant patient.

What is Medicare Part A? When Can You Enroll?

Medicare Part A is hospital insurance. It covers inpatient hospital, hospice, and skilled nursing facility care. Part A also covers home health care.

You can sign up for Part A:

- During your Initial Enrollment Period (IEP), if you’re not automatically enrolled, or

- At any time after you’re first eligible. If you qualify for premium-free Part A, you won’t have a penalty if you enroll past your IEP.6

Paying for Medicare Part A

Myth

Medicare Part A doesn’t cost anything.

Truth

You’re eligible for Part A with no monthly premiums if you’re 65 or older and you or your spouse worked and paid Medicare taxes for 10 or more years (40 quarters). Even if you don’t pay the Part A premium, there are out-of-pocket costs such as coinsurance and deductibles.7

If you’re under 65, you can get premium-free Part A after 24 months of disability benefits from Social Security or the Railroad Retirement Board, or if you have ESRD and meet certain requirements.8

If you don’t qualify for premium-free coverage, you can buy Part A for $259 per month (in 2021) if you paid Medicare taxes for 30 to 39 quarters. This amount can go up to $471 per month if you paid Medicare taxes for less than 30 quarters.9

If you don’t qualify for premium-free Part A and you don’t apply when you turn 65, you’ll have a penalty. The penalty may increase your premium by 10% when you do enroll.10

Who Is Eligible for Medicare Part B?

Part B medical insurance, the second piece of Original Medicare, covers outpatient services, such as doctors’ visits, lab work, and preventive care.

Here are the eligibility requirements to enroll in Medicare Part B.

- If you’re entitled to Part A with no monthly premiums, then you qualify for Part B when you’re eligible for Part A.

- If you have to buy Part A, then you can get Part B if:

- You’re an American citizen who lives in the country or a permanent resident who has lived here for five or more continuous years, and

- You’re 65 or older or under 65 and qualify for Medicare due to having a disability, ESRD, or ALS.

Your enrollment period for Part B is the same as Part A: during your Initial Enrollment Period when you first qualify for Medicare, or during the General Enrollment Period (January 1 to March 31).

Deciding Whether to Keep Medicare Part B When You Turn 65

If you’re automatically enrolled in Original Medicare, you’ll need to decide whether to keep Part B because you must pay a monthly premium for it.

If you (or your spouse) are still working when you turn 65 and you get health insurance through a union plan or a job with 20 or more employees, it may be best to delay Part B enrollment. Your employer or union coverage may already provide similar benefits to Part B.

You’ll get a Special Enrollment Period to sign up for Part B while you still have employer or union coverage or when that coverage ends.

Part B Late Enrollment Penalty

If you decide not to get Part B when you’re first eligible and you don’t qualify for special enrollment, you may be subject to a penalty when you do enroll. The penalty permanently increases your Part B premium by 10%.11

Who is Eligible for Medicare Part C?

Now, let’s look at Medicare eligibility for Part C, or Medicare Advantage. You’re eligible to enroll if you already have both Part A and Part B.* Coverage is provided through Medicare-approved private insurance companies. Every plan has a “service area” that you must live in to receive benefits.

*You typically aren’t eligible for Medicare Advantage if you have ESRD (kidney failure). However, some insurers offer Special Needs Plans that cover ESRD. That will change in 2021 when enrollment restrictions are lifted for enrollees with ESRD.

Part C Plans Are an Alternative to Original Medicare

Medicare Advantage plans provide Part A and Part B benefits. Most plans have built-in Part D prescription drug coverage. Some also offer other benefits, such as vision and dental coverage. You must continue to pay your Part B premium when you join Medicare Advantage.

There are specific times when you can enroll in Medicare Advantage. These include:

- Your Initial Enrollment Period (IEP), which starts three months before your 65th birthday and ends three months afterward.

- The annual Open Enrollment Period from October 15 to December 7, when you can switch between Original Medicare and Medicare Advantage.12

- The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. If you’re already enrolled in a Medicare Advantage plan, you can switch to a different one (with or without drug coverage) or drop your plan and return to Original Medicare.

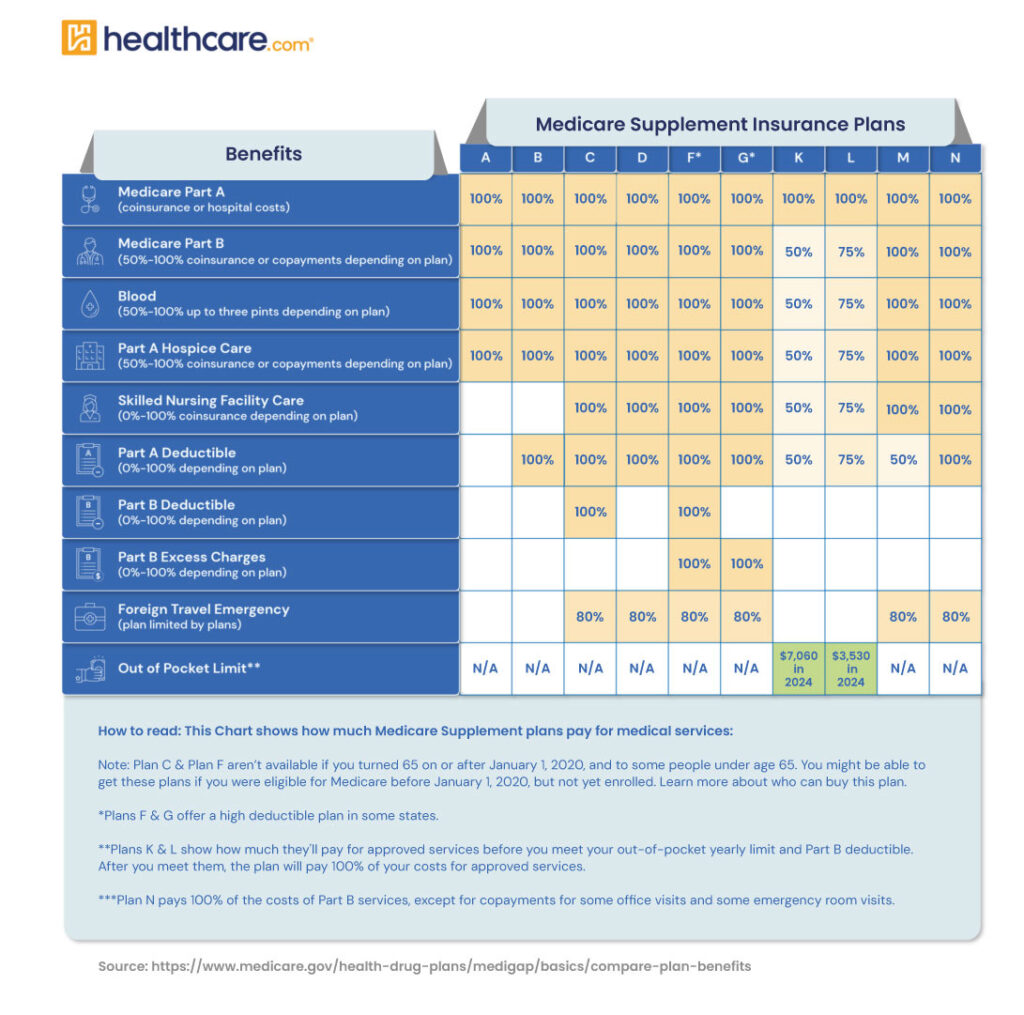

Myth: Medicare Supplement Insurance is Too Expensive

Many believe Medicare Supplement Insurance (Medigap) is costly, but premiums can be affordable based on your plan choice and finances. Key factors influencing costs include:

- Plan Type: Coverage varies by policy.

- Insurance Provider: Prices differ among companies.

- Location: Rates can change based on your area.

Comparing Medigap options is essential for finding a plan that fits your budget.

While open enrollment is the best time to enroll without underwriting, there are other options:

- Guaranteed Issue Rights: Life events like losing other coverage can allow enrollment without underwriting.

- Special Enrollment Periods: Triggered by significant changes in health coverage.

Who is Eligible for Medicare Part D?

You’re eligible for Part D if you have Medicare Part A and/or Part B. This applies to individual Medicare Part D prescription drug plans (PDPs). Remember, if you’re getting drug coverage through Medicare Advantage, you must have both Part A and B.

Myth

If I’m automatically enrolled in Original Medicare (Part A and B) or I sign up through Social Security, I will already have coverage for most prescription drugs.

Truth

Original Medicare doesn’t cover most medications. Many people who want to keep Original Medicare (instead of switching to Medicare Advantage) add a Part D plan for comprehensive drug coverage.

PDPs are also sold by private insurers, and you must live in the plan’s service area to enroll. Not all plans cover every drug. Check to make sure your prescriptions are covered.

You can also join a Part D plan when you’re first eligible for Medicare, or during open enrollment from October 15 to December 7.

What Happens If You Enroll in Part D Late?

If you don’t enroll in Part D when you’re first eligible and you didn’t have other drug coverage for 63 consecutive days, Medicare may charge a penalty when you enroll, adding it to your monthly premium. Part D premiums vary by plan.

If you’re concerned about drug coverage costs, Medicare has a program called Extra Help for people with limited incomes. There is no Part D penalty if you get Extra Help.13

Next Steps

When you know what you’re eligible for and when to enroll, you’ll be better prepared to get the most out of Medicare.

The Medicare program is administered by the Centers for Medicare & Medicaid Services (CMS), with help from the Social Security Administration (SSA) and the Railroad Retirement Board (RRB). Medicare is separate from Medicaid. Medicaid is a health insurance program that’s administered by states and the federal government, and is typically only available to people with low incomes. It’s possible to qualify for both Medicare and Medicaid.