As you may already know, once you enroll in Medicare, many — but not all — of your healthcare expenses will be covered. But before you get covered, you have decisions to make on your coverage.

For example, when you purchase “basic” Medicare — also known as Original Medicare — you get coverage for both hospital care (Medicare Part A) and outpatient healthcare (Medicare Part B). But Original Medicare doesn’t include your prescription medications, so you may choose to pay for a Part D policy that will cover any drugs you’re taking.

Another option is to enroll in a Medicare Advantage plan (also called Medicare Part C). Medicare Advantage plans are bundled plans offered by private insurers that include Medicare Parts A and B and may also include outpatient prescription drug coverage (aka Medicare Part D, as mentioned above).

If you choose Original Medicare rather than Medicare Advantage, or there are no Medicare Advantage plans available in your area, there is insurance to pay for healthcare expenses not covered by Original Medicare, what’s called Medicare Supplement Insurance.

Here’s what you need to know about supplemental insurance and how to find a policy that’s right for you.

What Is Medicare Supplement Insurance?

Adding Medicare Supplement Insurance (also known as a Medigap policy) fills in the gaps that Original Medicare doesn’t cover, including expenses like deductibles, copays and coinsurance.1

This kind of policy can help reduce your healthcare costs.2 And some Medigap plans may cover you if you need care while traveling out of the country, something Original Medicare doesn’t include.3

Like Medicare Advantage plans, Medigap policies are offered by private insurance companies. Keep in mind that while you can buy a Medigap policy if you have Original Medicare, you’re not able to do so if you’re enrolled in a Medicare Advantage plan.

What Does Medicare Supplement Insurance (Medigap) Cover?

If you have Original Medicare and a Medigap policy, Medicare will pay its share of the Medicare-approved amounts for covered healthcare costs, and then your Medigap policy will kick in to pay its share. (Medicare won’t pay any of the cost for you to have a Medigap policy, by the way.)4

Medigap policies generally don’t cover long-term care, vision or dental care, hearing aids, eyeglasses or private nursing.5

In all but three states (Minnesota, Massachusetts and Wisconsin), all Medigap plans have to follow federal and state laws and must be clearly identified as “Medicare Supplement Insurance.” Every standardized Medigap plan must offer the same basic benefits, regardless of which insurance company sells it.6 (If you live in Massachusetts, Minnesota or Wisconsin, Medigap policies there are standardized differently.)7

These are the basic benefits included in every Medigap plan (though be sure to note that Medigap Plans K and L provide only partial coverage):

- Hospital coinsurance coverage.

- 365 additional days of full hospital coverage.

- Full or partial coverage for the 20% percent coinsurance for provider charges and other Part B services.

- Full or partial coverage for the first three pints of blood you might need in a given year.

- Full or partial coverage of hospice coinsurance for drugs and respite care.

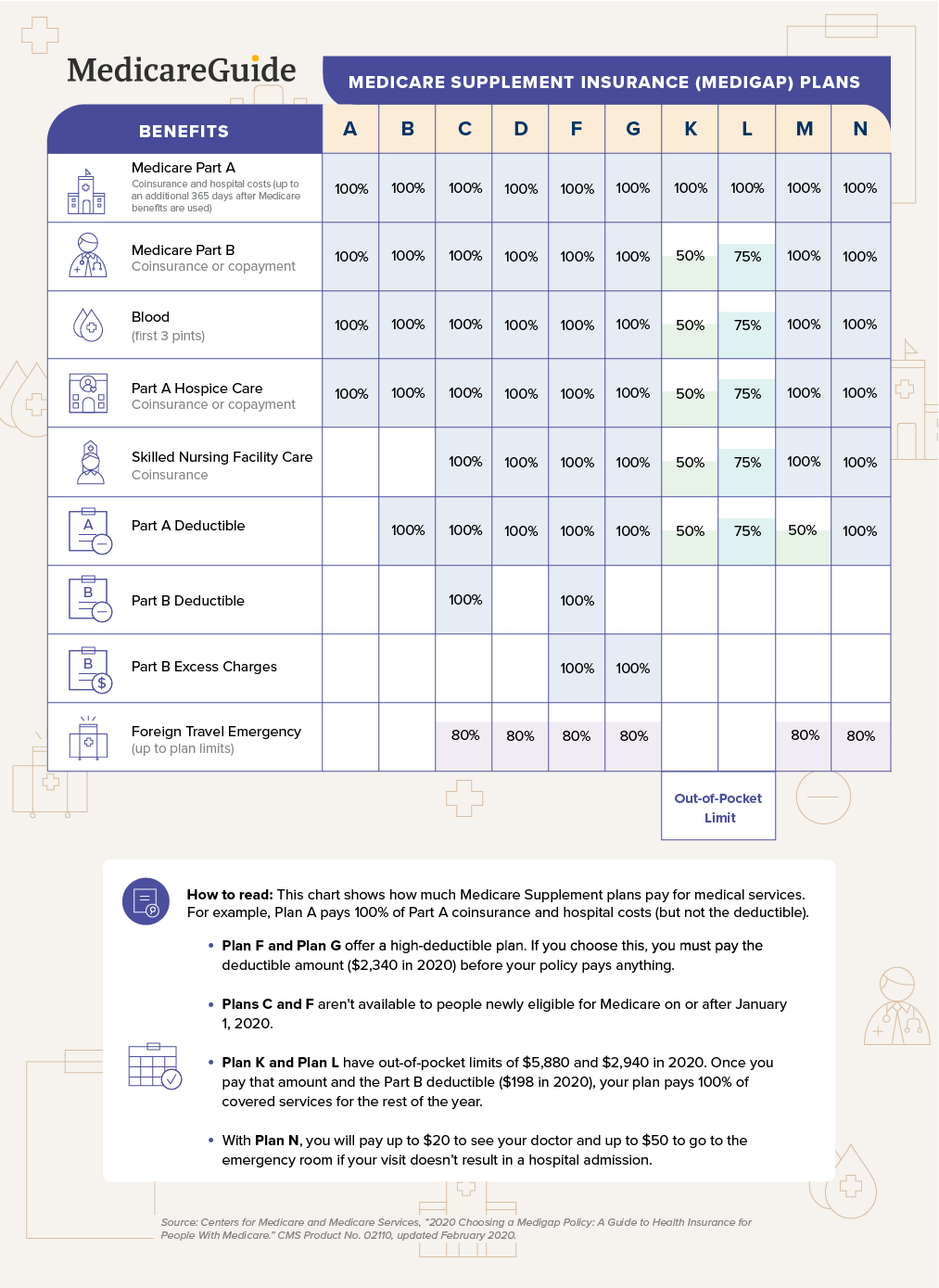

Once you start looking around, you’ll see there are a variety of plans, each identified by a letter: A, B, C, D, F, G, K, L, M and N.8 The chart below will help you compare what is and isn’t included in the various lettered Medicare Supplement Insurance plans.

How Can You Compare & Choose a Medigap Policy?

Start by looking at the chart below of lettered Medigap policies to see which benefits come with each plan.

- Medigap Plan A is the most basic coverage, covering only the basic benefits (listed in the first four rows of the chart) and also has the lowest premiums compared to other plans sold by the same company.9 (Note: Insurance companies that sell Medigap policies are required to sell Plan A as well as either Plan D or Plan G.)

- Medigap Plan B has the basic benefits plus one more: It covers your Part A deductible.

- Plan C has three more benefits than Plan B, covering the Part B deductible, the skilled nursing facility copay and foreign-travel emergency care. Plan C has one more benefit than Plan D; Plan D does not cover the Part B deductible.

- Medigap Plan F has all the benefits, but it’s available only to people who became eligible for Medicare before January 1, 2020. For those who became eligible for Medicare on or after January 1, 2020, the Medigap plan with the most benefits is Medigap Plan G, which is comparable to Plan F except it does not cover the Part B deductible.

- Medigap Plans K and L are designed differently because they cover benefits at less than 100% and have annual out-of-pocket limits. When you pay your coinsurance, it will be counted toward the annual out-of-pocket limit. If, for example, you have Plan L, for Part B services you would pay 25% of the 20% after Medicare has paid the Medicare-approved amount. So if the Medicare-approved amount for a Part B service is $100, Medicare would pay 80% ($80) and the remaining 20% ($20) would be paid by Plan L at 75% ($15) and by you at 25% ($5). If your coinsurance payments total the out-of-pocket limit, the plan will pay 100% of covered benefits for the remainder of the year. The out-of-pocket limit resets the next plan year.

- Medigap Plan M and Plan N cover the same benefits as Plan D with the following differences: Plan M covers the Part A deductible at 50%; and Plan N covers the Part B coinsurance but has copays (up to $20 for office visits and up to $50 for ER visits unless the patient is admitted as an inpatient).

Consider how much coverage you want for each of the benefits listed to find the lettered plan that’s right for you. When you have decided on a Medicare Supplement Insurance plan, select three to five Medigap policy insurance companies and reach out to them to ask what they charge for that plan.

Check, too, with your state’s department of insurance for a list of companies that sell Medigap policies; some include the list on their website. You may also want to ask your doctor’s office which insurance companies the doctor works with or your family and friends who have a Medigap policy if they’re happy with their coverage.

To get a complete sense of your total costs, be sure you understand not only what your monthly premium would be, but also the deductible, copays and coinsurance.10 To estimate your Medicare and Medigap costs for the year, include your premiums for Part B, the Medigap policy and the Part B annual deductible (unless you have Medigap Plan C or Plan F).

Some expenses are unpredictable. For instance, the Part A deductible kicks in if you need to be admitted to the hospital. How much you need to pay in copays and coinsurance depends on how many services and which ones you need and which Medicare Supplement Insurance plan you have. Since it is an estimate, you might want to err on the side of overestimating.

What Are Medigap Policy Costs?

Premiums

The monthly premium you pay for your Medigap policy is based on the plan you choose and what the insurer charges. Every plan of the same letter will have the same features, but insurers can charge different prices.

Companies that sell Medicare Supplement Insurance use one of three ways to set premiums:

- Community-rated: Everyone that buys the policy pays the same premium, regardless of age. Premiums increase due to inflation, healthcare costs and other reasons, but not because of your age.

- Issue-age-rated: Premiums are based on the age at which you first purchase a policy. Your premium may go up due to inflation, healthcare costs, and other reasons, but not because of your age.

- Attained-age-rated: Premiums are tied to your current age. Companies that set premiums this way can increase your premium every year or every few years based on your age.

Cost-sharing

Most important now is seriously considering what you will have to pay out-of-pocket in the event that you need care Medicare doesn’t provide. All Medicare Supplement Insurance plans pay the Medicare Part B coinsurance, whether fully or partially (Plans K and L), since it is a basic benefit. Plans A through G cover most benefits at 100%, so you wouldn’t have any out-of-pocket expenses for Part B covered.11

But there are out-of-pocket expenses if your Medigap does not cover other benefits. For example, Medicare Supplement Insurance Plan A is the most basic plan and has a lower premium than Plan G, but if you’re admitted into a hospital, you will have to pay the Part A deductible out-of-pocket.

Looking through the chart of lettered plans above makes it easier to see how much coverage you’ll get for the following benefits, depending on the plan you choose:

- Hospital deductible.

- Skilled nursing facility coinsurance.

- Medicare Part B deductible. (Remember that those who are first eligible for Medicare on or after January 1, 2020, cannot purchase a Medigap policy that pays for the Part B deductible.)

- Emergency care outside the U.S.

- Excess charges (some Medigap plans will pay more than the Medicare-approved amount some doctors can charge).12

The cost of your Medigap policy will also depend on discounts some insurers offer, such as lower prices for women, being a smoker, being married and paying online instead of by check.13

When Should You Buy a Medigap Policy?

All states allow for “guaranteed issue,” which means that you have the right to buy a Medigap policy for six months starting the first day of the month you are at least 65 and enrolled in Medicare Part B.

During this enrollment period, an insurance company cannot turn you down for a Medigap policy or charge you more for a preexisting health condition.14

If you don’t buy a Medigap policy during that period, you’re only entitled to a guaranteed issue Medigap policy in certain situations:

- Your Medicare Advantage plan closes.

- You move out of the area.

- Your retiree plan shuts down.

- You joined a Medicare Advantage plan at age 65 but decided to switch back to Original Medicare within a year.

- Your Medigap policy closes.15

There’s some homework to do to figure out the right choice, but it will be well worth it. The best Medigap policy can ensure you have the coverage you want at a price you can afford and, most important, help you manage healthcare costs that Medicare won’t cover.