Stay Covered with Medicare Supplement Plans in Wisconsin

Are you enrolling in Medicare and worried about getting the coverage you need? Medicare Part A and B, or Original Medicare, may not cover all of your medical costs. See how Medicare Supplement plans in Wisconsin could fill the gaps in your Medicare coverage.

What are Medicare Supplement Plans in Wisconsin?

Medicare Part A and Part B won’t cover 100% of your medical bills, and there isn’t a cap on out-of-pocket costs. You need a way to bridge these gaps in your coverage. That’s where Medicare Supplement can help.

Medicare Supplement plans, or Medigap policies, fill some or all of the gaps in Original Medicare. You pay a premium each month for this additional coverage.

What You Need to Know

Medicare Supplement plans help pay out-of-pocket costs not covered by Medicare Part A and B.

In most cases, you can’t enroll in a Medicare Advantage plan and have a Medigap policy.

Medigap policies in Wisconsin have different standardization than other states.

When Can You Enroll in Medigap?

Buying a Medigap policy isn’t the same as enrolling in Medicare. You’ll need to purchase your plan from a private insurance provider.

You’re first eligible to purchase a Medigap policy for the six months after you turn 65 and enroll in Medicare Part B. This is known as your Medigap Open Enrollment Period.1

During Your Medigap Open Enrollment Period

This is the best time to sign up for a Medigap policy. During this time, insurance companies can’t deny you coverage or charge you extra based on any health issues or preexisting conditions you have. That means you’ll likely get the best prices and options.

Did You Know?

You can buy a Medicare Supplement plan as soon as you’re eligible for Medicare.

Outside of Open Enrollment

You can still apply for a Medigap policy in Wisconsin outside of your Open Enrollment Period. Be aware, however, that insurance providers can request health information in your application. They can charge you more or deny your application if you have health issues and don’t meet their medical underwriting requirements.

Guaranteed issue rights

Certain situations allow you to sign up for any Medigap policy without penalty — even if you’re outside your Medigap Open Enrollment Period. These situations give you a guaranteed issue right, or protection when choosing a Medicare Supplement plan.2 Some situations include:

- You move out of the coverage area of your Medicare Advantage plan.

- You have an employer or group health coverage and the plan is ending.

- You drop Medigap coverage to join a Medicare Advantage plan and decide to switch back within the trial period of a year.

What Are the Most Popular Medicare Supplement Plans in Wisconsin?

Most states require insurance companies to offer standardized Medigap policies, designated by letters (such as Plan F, G or N). Wisconsin, however, uses its own standardized plans.

Each Wisconsin Medicare Supplement plan must cover certain benefits, including:3

- Medicare Part A coinsurance for inpatient hospital care

- Medicare Part B coinsurance for medical care

- The first three pints of blood per year for blood transfusions

- Medicare Part A hospice coinsurance or copayment

The specific Medicare Supplement plans available in Wisconsin are:

- Basic Plan: The basic Medicare Supplement plan in Wisconsin covers all of the above benefits, as well as Part A coinsurance for skilled nursing facilities. You’ll also get coverage for 40 additional home health visits and 175 additional days of inpatient mental health care.

- 50% Cost-Sharing Plan: This plan is similar to the national standardized Plan K.

- 25% Cost-Sharing Plan: This plan is similar to the national standardized Plan L.

- Medigap riders: You can customize your Medigap policy in Wisconsin with options such as coverage for your Part A deductible or additional home health care.

Did You Know?

In Wisconsin, you can add options to your Medigap policy to customize your level of coverage.

How Do You Choose a Medicare Supplement Plan?

One of the advantages of Wisconsin’s Medigap policy options is that you can customize coverage to fit your needs.

Start with the basic Medicare Supplement plan and add options that will most benefit you. For example, you can add more home health care coverage if you have health issues that require in-home treatment.

How Much do Medigap Policies Cost in Wisconsin?

Despite the basic coverage requirements, Medigap policies in Wisconsin can vary between insurance providers. This means one insurance company may charge more than another for a plan that covers the same services.

Remember, your Medicare coverage doesn’t include the cost of a Medigap policy. You’ll have to pay the premiums yourself.

65-Year-Old Woman, No Tobacco Use

| Plan Type | Premium Range |

| Medigap 25% Cost Sharing Plan | $105-$154 |

| Medigap 50% Cost Sharing Plan | $82-$123 |

| Medigap Basic Plan | $94-$308 |

65-Year-Old Man, No Tobacco Use

| Plan Type | Premium Range |

| Medigap 25% Cost Sharing Plan | $105-$154 |

| Medigap 50% Cost Sharing Plan | $83-$124 |

| Medigap Basic Plan | $103-$348 |

What Companies Sell Medigap in Wisconsin?

What if You Want to Change Your Medigap Policy?

Here are some reasons the Medigap policy you chose might not fit your needs:4

- You’re paying for more benefits than you need

- You aren’t getting enough benefits from your current plan

- You want to work with a different insurance company

- You want to pay less in monthly premiums

You can switch Medigap policies during your Open Enrollment Period without penalty. For example, you sign up for a Medigap policy on your 65th birthday but decide it’s not the right fit after two months. Since you’re still in your Open Enrollment Period, insurance companies can’t deny your application or charge you a higher fee.

You can change your Medigap policy outside of your Open Enrollment Period. However, you might not want to unless you have a guaranteed issue right from a special circumstance. If you switch Medigap policies outside of your Medigap Open Enrollment Period, you’ll likely have to undergo medical underwriting.

What Are Alternatives to Medicare Supplement?

Medicare Supplement plans aren’t your only option for additional health insurance. Other options include:

- Medicare Advantage: Medicare Advantage plans provide Medicare benefits through a private health insurance plan. Medicare Advantage, or Medicare Part C, usually includes benefits like vision and prescription drug coverage. It works like an HMO or PPO, meaning you’re restricted to in-network providers.5

- Medicaid: Medicaid is the government-run health insurance program for low-income Americans. You must meet certain income requirements to be eligible for Medicaid in Wisconsin.

What Are the Medicare Resources in Wisconsin?

The best place to find answers to your Wisconsin Medicare questions is through programs funded by the State Health Insurance Assistance Program (SHIP), such as:

- The Medigap Helpline (800-242-1060)

- Wisconsin Medigap Part D Prescription Drug Helpline (855-677-2783)

- Speak with your local Benefits Specialist

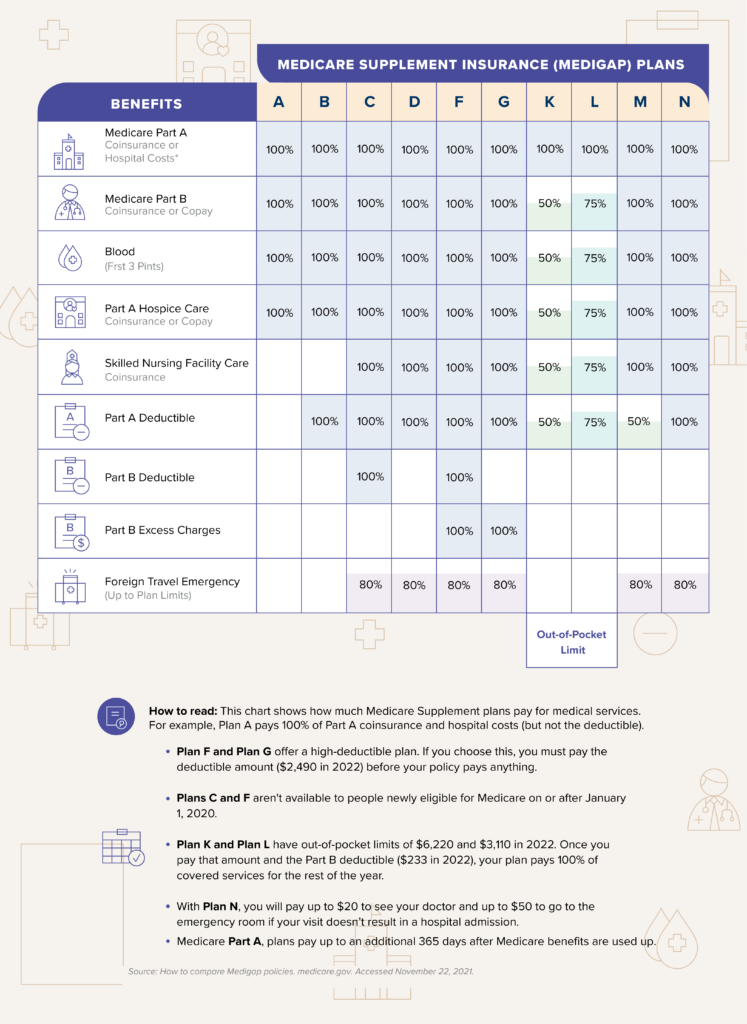

Medigap Chart

Although Wisconsin has its standardized Medigap policies, you can compare plans with similar benefits using our printable Medigap comparison chart.

Snippet Render Is Present – D3 cannot be loaded in editor mode. Go to preview or publish mode.

What’s the Next Step?

Ready to learn more about Medigap policies in Wisconsin? Use the resources above to find answers to your questions. You can also talk with a Medicare Supplement broker to help you create a Medigap policy that works for you.