Written by Paige Cerulli

HealthCare Writer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

What You Need to Know

- Medicare Supplement plans, also known as Medigap, help pay for out-of-pocket costs not covered by Medicare Part A and Part B.

- Hawaii insurance companies must accept your Medicare Supplement (Medigap) plan application if you’re in your Medigap Open Enrollment Period or have guaranteed issue rights.

- The three most popular Medigap policies are typically Plans F, G, and N.

What Are Medicare Supplement Plans in Hawaii?

Medicare is a federal health insurance program for individuals aged 65 and older, as well as younger people with qualifying disabilities or health conditions (e.g., end-stage renal disease).

Original Medicare includes Part A (Hospital Insurance) and Part B (Medical Insurance), which cover many healthcare services. However, they still leave you with out-of-pocket costs such as deductibles, coinsurance, and copayments. Medicare Supplement plans help pay for these expenses.

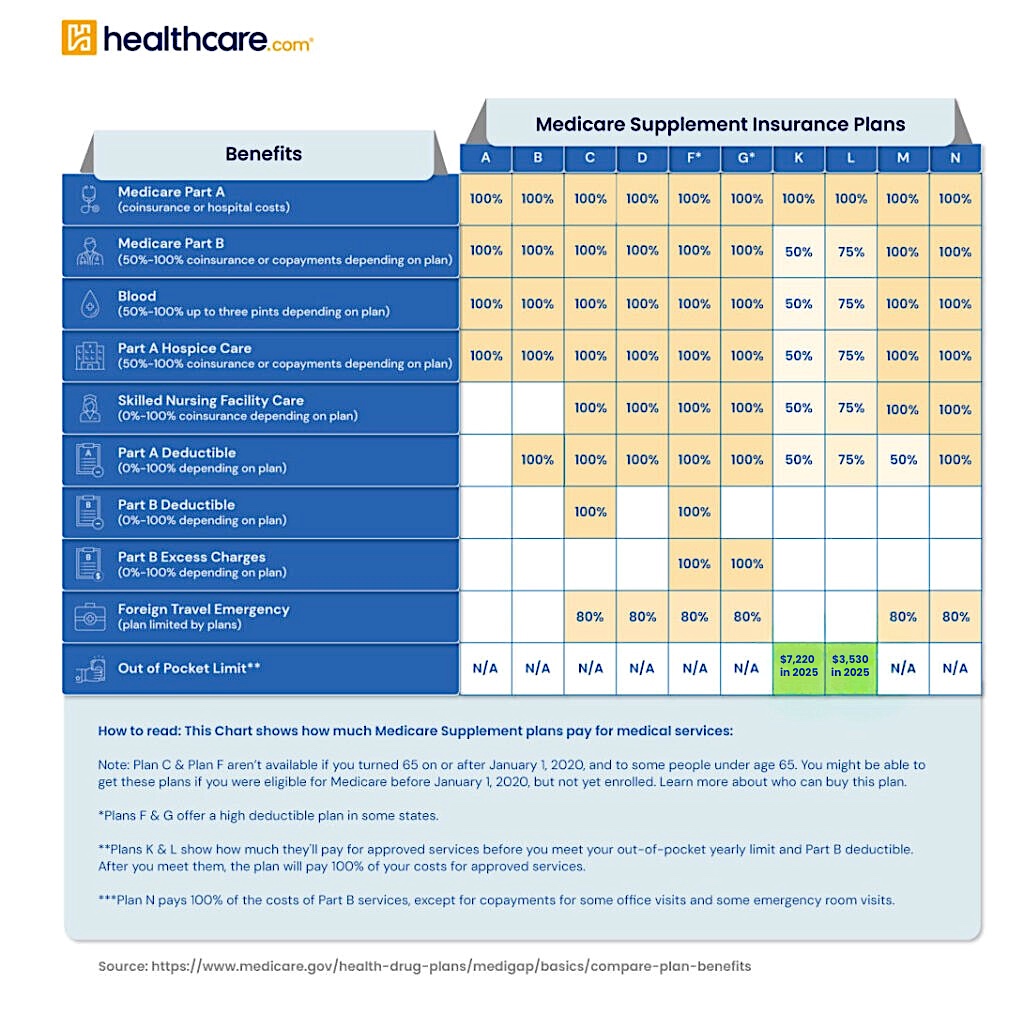

Medigap plans are standardized by letter (A through N), meaning Plan A offers the same benefits regardless of the insurer. However, premiums and service quality can vary between companies.

Learn how these plans work and how they benefit residents of Hawaii.

Compare options HERE & start your health plan journey.

When Can You Enroll in a Medicare Supplement (Medigap) Policy?

You can apply for a Medigap plan at any time. However, outside of your Medigap Open Enrollment Period—or without guaranteed issue rights—insurers may review your health history and deny coverage or charge higher premiums.

Your Medigap Open Enrollment Period lasts six months and begins the month you’re both age 65 (or older) and enrolled in Medicare Part B. During this window, insurers must offer you any Medigap plan they sell, regardless of your health condition.

Guaranteed issue rights apply in certain situations, such as:

- Moving out of your Medicare Advantage plan’s service area

- Losing other health coverage (e.g., an employer plan)

- Switching back to Original Medicare after trying a Medicare Advantage plan for less than a year

- Losing your current Medigap plan through no fault of your own

What Are the Most Popular Medicare Supplement Plans?

Nationwide and in Hawaii, the most popular Medigap plans are:

- Plan F: Offers the most comprehensive benefits but is only available to individuals who became eligible for Medicare before January 1, 2020.

- Plan G: Covers nearly everything Plan F does, except for the Medicare Part B deductible.

- Plan N: Covers many of the same costs as Plan G but includes copayments for doctor and emergency room visits and does not cover Part B excess charges.

These plans differ in terms of how much you’ll pay out of pocket when you access healthcare services, so it’s important to compare carefully.

How Do You Choose a Medicare Supplement Plan?

Decide on a plan letter (e.g., G or N) based on your healthcare needs and budget. Consider:

- How often you visit doctors or need outpatient services

- Whether you want to minimize out-of-pocket costs, even if it means a higher premium

- If you’re comfortable with copayments or prefer a plan that covers nearly everything

Compare plans across different insurance companies. Even though coverage is standardized, pricing can vary based on:

- Attained age rating: Premiums increase as you age

- Issue age rating: Premiums are based on the age when you purchase the plan

- Community rating: Premiums are the same for everyone, regardless of age

Always compare the same plan letter across different companies to get the best value.

How Much Do Medigap Policies Cost?

Medigap premiums in Hawaii vary based on:

- Your age and gender

- Tobacco use

- Plan type

- The pricing method used by the insurer

Because pricing methods vary between insurers, it’s important to compare the same plan (e.g., Plan G) from multiple companies before enrolling.

What If You Want to Change Your Medicare Supplement Plan?

You can apply to change Medigap policies at any time. However, unless you qualify for guaranteed issue rights, insurers may underwrite your application, which could result in a denial or higher premiums based on your health.

To avoid complications, it’s ideal to choose the most suitable plan during your initial Open Enrollment Period.

Compare options HERE & start your health plan journey.

What Are Alternatives to Medicare Supplement Plan?

Medicare Advantage plans, also known as Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies and typically include:

- Part A and Part B

- Most include Part D (prescription drug coverage)

- Extra benefits like dental, vision, hearing, and wellness programs

Instead of buying a Medigap and a separate drug plan, you may prefer a bundled Medicare Advantage plan.

Learn more about Hawaii Medicare Advantage plans.

Medicare Part D?

Medicare Part D plans offer standalone prescription drug coverage.

- Who needs it: Those with Original Medicare who want help covering medication costs

- What it covers: Prescription drugs, with coverage and costs that vary by plan

- How it’s offered: Through private, Medicare-approved insurers

- Not needed if: You’re enrolled in a Medicare Advantage plan that already includes drug coverage

Shop for a Medicare plan with additional benefits!

Do Medigap Plans Cover Prescription Drugs?

No. Medigap plans do not include prescription drug coverage. If you want drug coverage, you’ll need to enroll in a separate Medicare Part D plan.

Medicare Resources in Hawaii

Residents of Hawaii can access free help through these programs:

- Hawaii State Health Insurance Assistance Program (SHIP): Provides one-on-one Medicare counseling to help you understand your options and compare plans.

- Hawaii Insurance Division: Assists with complaints and regulatory oversight for Medigap providers.

- Med-QUEST (Hawaii’s Medicaid Program): Offers healthcare coverage for low-income residents and can coordinate benefits with Medicare. It also helps with applications and provides access to community resources.

Next Steps

If a Medicare Supplement plan in Hawaii seems right for you, start by choosing a plan letter that fits your medical and financial needs.

Then, compare offerings from multiple insurance companies to find the best rate and customer experience.

Consider whether you also need a Part D plan or would benefit more from a Medicare Advantage plan.

Thank you for your feedback!

Medicare.gov. Medicare. “When Can I Buy Medigap?” medicare.gov. (accessed November 24, 2020).

Medicare.gov. “Guaranteed Issue Rights.” medicare.gov. (accessed November 24, 2020).

Medicare.gov. “Special Circumstances (Special Enrollment Periods).” medicare.gov. (accessed November 24, 2020).

Medicare.gov. “Supplement Insurance (Medigap) plans in Hawaii.” medicare.gov. (accessed November 24, 2020).

Medicare.gov. “Medicare Advantage Plans.” medicare.gov (accessed November 24, 2020).