What You Need to Know

You can sign up for Medicare Supplement Plan F if you were eligible for Medicare before January 1, 2020.

If you aren’t eligible for Plan F, consider Plan G or N as alternatives.

If you choose Plan F, you will usually only pay the premium and little else.

Medicare Supplement Plan F is the most comprehensive private insurance policy available to go with Medicare Part A and Part B. It pays the out-of-pocket costs associated with Parts A and B — including deductibles and the 20% coinsurance after the Part B deductible, and more.

In addition to covering your out-of-pocket costs, Plan F travels well. As long as you see a provider in the United States who accepts Medicare, you will be covered. This is a nice benefit for “snow birds” or people who like to travel.

However, because of a change in the law back in 2015, people who first become eligible for Medicare after January 1, 2020, can no longer buy a Medicare Supplement Plan F.

What Does Plan F Cover?

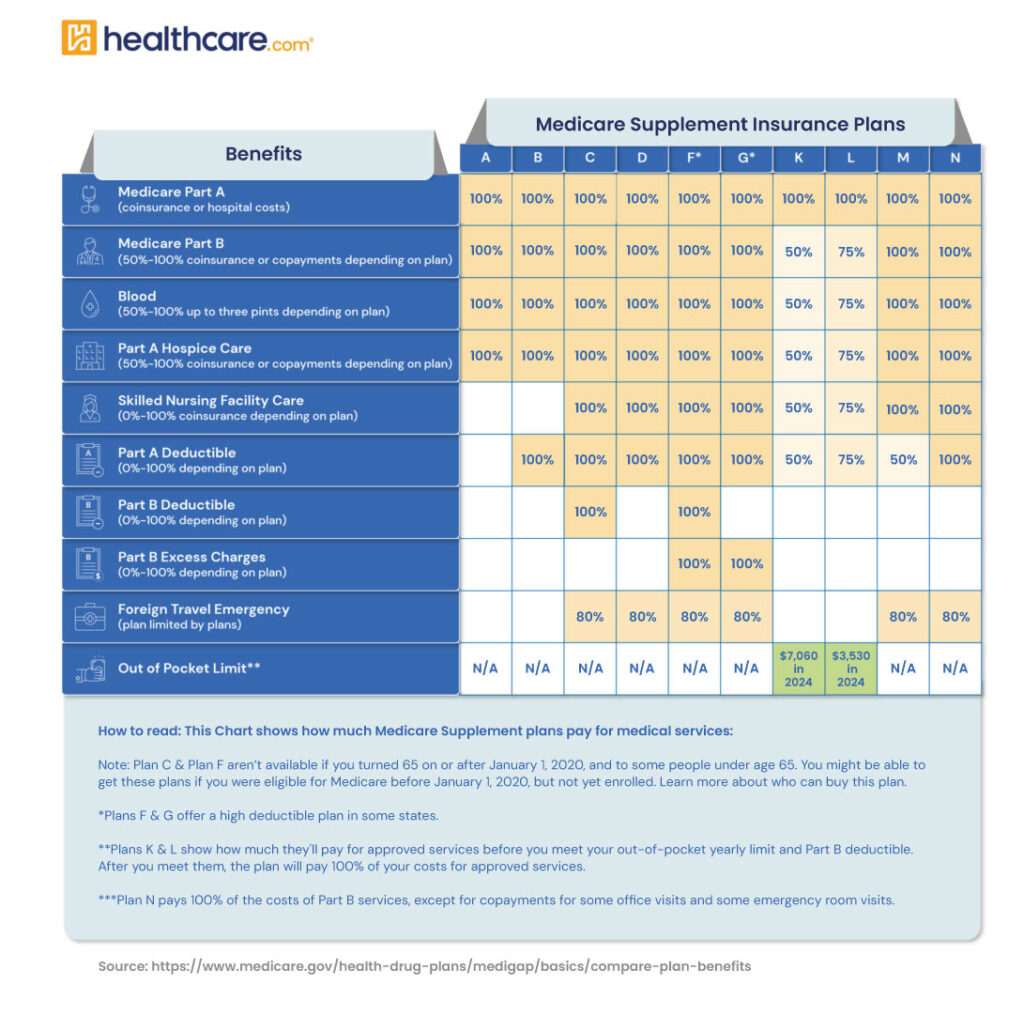

Plan F is a Medicare Supplement plan, also known as a Medigap policy, that is offered by private insurance companies. It pays Medicare costs for you in exchange for a monthly premium. Benefits include:

Part A:

Covers coinsurance and hospital costs for 365 days after Medicare ends, including the Part A deductible and hospice care coinsurance.

Part B:

Covers coinsurance, copayments, the Part B deductible, and excess charges, including the full 20% of Medicare Part B costs.

Other Benefits:

Includes skilled nursing facility coinsurance, first three pints of blood transfusions, and foreign travel emergency coverage.

This is not an exhaustive list, so be sure to review plan documents and Summary of Benefits to understand all of the coverage you have available under Plan F.

No Drug Coverage

Medigap policies don’t cover your prescriptions.

How Much Does Plan F Cost?

Many private insurance companies will compete for your business by offering different prices. Keep in mind though that, in most cases, you will pay the premium and little else for medical services. That means that by choosing a monthly premium that fits your budget, you should not have to worry about large, unexpected medical bills.

Plan F also comes in a “high deductible” option. In exchange for a lower monthly premium, you pay an up-front deductible for medical care.

Who Can Enroll in Plan F?

Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

If your 6-month period has ended and you don’t qualify for a Special Enrollment Period (SEP) you can apply to enroll in Plan F by completing an application that asks about your health history. The insurance company can decline your application and/or request medical records to determine whether it will accept you.

What Are Alternatives to Plan F?

If you are not eligible for Plan F, you could consider Plan G or Plan N as options.

Plan G

Plan G offers similar coverage to Plan F with the exception of the Medicare Part B deductible.

Additionally, it covers the Medicare Part A deductible and coinsurance days for inpatient hospital stays beyond 60 days. It will also cover the 20% coinsurance after the Part B deductible and the excess charges amount. Plan G comes in a high-deductible option, similar to Plan F, with lower premiums.

Plan N

Plan N is another option that has broad coverage. You can expect to pay the Medicare Part B deductible and the excess charges with Plan N, as well as copayments for doctors’ visits and emergency room visits. The plan will pay other covered services like the Part A deductible and daily coinsurance costs as well as the Part B 20% coinsurance.

It is important to remember that Medicare Supplement or Medigap policies do not cover your prescriptions. You will want to look at a Medicare Part D plan to go along with your Medicare Supplement or Medigap policy to offset the potentially high costs of medications.

Next Steps

In the end, although Medicare Plan F is no longer available for people turning 65, there are options. And you are still able to purchase comprehensive coverage to keep your out-of-pocket costs controlled. Seek the advice of a Medicare specialist in your area to get the best information on plan options.