Written by Paige Cerulli

HealthCare Writer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

What You Need to Know

- Medicare Supplement plans, also known as Medigap, help pay for out-of-pocket costs not covered by Medicare Part A and Part B.

- Arizona insurance companies must accept your Medicare Supplement (Medigap) plan application if you’re in your Medigap Open Enrollment Period or have guaranteed issue rights.

- The three most popular Medigap policies are typically Plans F, G, and N.

What Are Medicare Supplement Plans in Arizona?

Medicare is a federal health insurance program for individuals aged 65 and older, as well as younger people with qualifying disabilities or health conditions (e.g., end-stage renal disease).

Original Medicare includes Part A (Hospital Insurance) and Part B (Medical Insurance), but it doesn’t cover all healthcare costs. You may still have to pay deductibles, copayments, and coinsurance. Medicare Supplement plans help cover those expenses and are sold by private insurance companies.

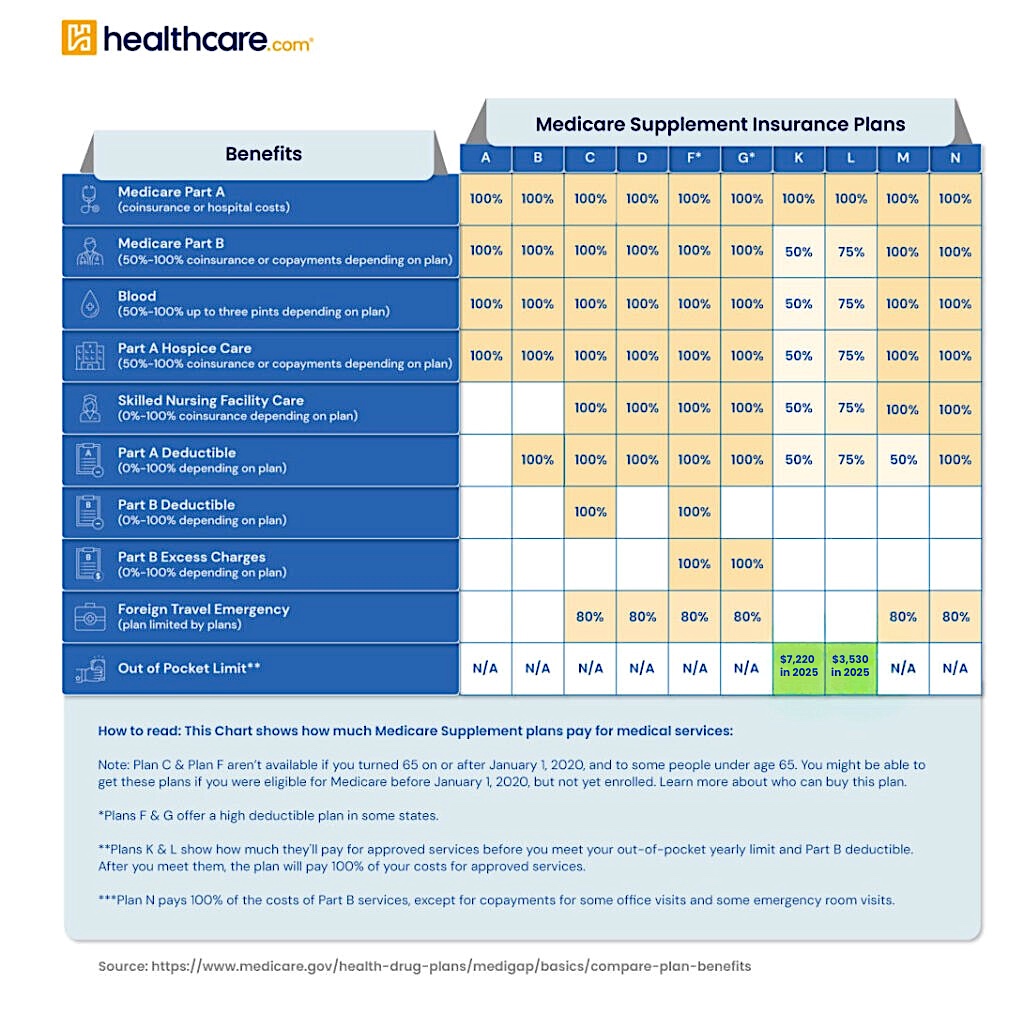

Medigap plans are standardized and identified by letters A through N. Each lettered plan provides the same benefits regardless of the insurer, though pricing may vary. These plans can help reduce or eliminate your out-of-pocket costs and provide peace of mind, especially if you have frequent healthcare needs.

When Can You Enroll in a Medicare Supplement (Medigap) Policy?

You can apply for a Medigap policy at any time. However, the best time to enroll is during your Medigap Open Enrollment Period.

This six-month window starts the month you’re both age 65 (or older) and enrolled in Medicare Part B. During this period, insurance companies must accept your application and cannot charge more due to preexisting conditions.

After your Open Enrollment Period ends, insurers may require medical underwriting, which means they can deny your application or charge higher premiums based on your health history—unless you qualify for guaranteed issue rights.

Guaranteed issue rights apply in situations such as:

- Your Medicare Advantage plan ends or you move out of its service area

- You lose employer-sponsored or union coverage

- You return to Original Medicare within 12 months of enrolling in a Medicare Advantage plan

Compare options HERE & start your health plan journey.

What Are the Most Popular Medicare Supplement Plans?

The most commonly selected Medigap plans in Arizona and nationwide are:

- Plan F: Offers the most comprehensive coverage but is only available to those who were eligible for Medicare before January 1, 2020.

- Plan G: Covers nearly everything Plan F does, except the Medicare Part B deductible.

- Plan N: Covers many major costs but requires copayments for some doctor and emergency room visits and does not cover Part B excess charges.

All three plans help reduce your out-of-pocket costs, but the right choice depends on your health needs and budget preferences.

How Do You Choose a Medicare Supplement Plan?

When selecting a Medigap policy in Arizona, consider:

- The type and frequency of healthcare services you use

- Whether you want predictable monthly premiums vs. occasional out-of-pocket costs

- If you need coverage when traveling outside Arizona or abroad

- Whether your healthcare providers accept Medicare

After choosing a plan letter (e.g., G or N), compare quotes across insurers. Benefits are standardized, but premiums vary based on how insurers set their rates:

- Attained-age rating: Premiums increase as you get older

- Issue-age rating: Premiums are based on your age when you first purchase the plan

- Community rating: Everyone pays the same premium, regardless of age

Always compare the same plan type from different companies—such as Plan G vs. Plan G—for an accurate evaluation.

How Much Do Medigap Policies Cost?

Medigap premiums in Arizona vary depending on:

- Your age and gender

- Whether you use tobacco

- The plan type you choose

- The insurer’s pricing method

While the benefits are the same across all insurers for each plan letter, prices may differ significantly.

What If You Want to Change Your Medicare Supplement Plan?

You can apply to change your Medigap plan at any time. However, unless you qualify for a guaranteed issue right or are still within your Medigap Open Enrollment Period, insurers may use medical underwriting to evaluate your application.

This is why it’s important to carefully choose the right plan during your Open Enrollment Period, when you’re protected from being denied or charged more due to your health history.

Compare options HERE & start your health plan journey.

What Are Alternatives to Medicare Supplement Plan?

Medicare Advantage plans are another option for Arizonans seeking Medicare coverage. These plans are offered by private insurance companies and include Part A and Part B coverage, and often Part D for prescriptions.

Medicare Advantage plans may also include extra benefits such as dental, vision, and hearing services. Unlike Medigap, they typically use provider networks (HMOs or PPOs), which may limit your provider choices.

You cannot enroll in both a Medigap plan and a Medicare Advantage plan at the same time.

Learn more about Arizona Medicare Advantage plans.

Medicare Part D?

Medicare Part D plans offer standalone prescription drug coverage.

- Who needs it: Anyone with Original Medicare who wants drug coverage

- What it covers: Prescription medications (varies by plan)

- How it’s offered: Through Medicare-approved private insurers

- Not needed if: You are enrolled in a Medicare Advantage plan that includes drug coverage

Shop for a Medicare plan with additional benefits!

Do Medigap Plans Cover Prescription Drugs?

No. Medigap plans do not include prescription drug coverage. If you need this coverage, you should enroll in a separate Medicare Part D plan.

Medicare Resources in Arizona

Arizonans can access free, personalized help through several statewide programs:

- State Health Insurance Assistance Program (SHIP): Offers one-on-one Medicare counseling

- Senior Medicare Patrol (SMP): Educates beneficiaries on avoiding scams and fraud

- Arizona Department of Insurance and Financial Institutions: Provides guidance for insurance complaints and appeals

- Arizona Medicaid Program: Offers additional coverage and financial support for eligible low-income residents

Next Steps

If a Medicare Supplement plan in Arizona fits your needs, start comparing your options well before your 65th birthday. Enroll during your Medigap Open Enrollment Period to avoid medical underwriting and get the widest choice of plans. You can compare plans online or speak with a licensed insurance agent for expert guidance and support.

Thank you for your feedback!

U.S. Government Website for Medicare. “When Can I Buy Medigap?” medicare.gov (accessed February 6, 2021).

U.S. Government Website for Medicare. “Guaranteed Issue Rights.” medicare.gov (accessed February 6, 2021).

U.S. Government Website for Medicare. “Special circumstances (Special Enrollment Periods).” medicare.gov (accessed February 6, 2021).

The State of Medicare Supplement Coverage. ahip.org. Accessed October 22, 2021.

Costs of Medigap policies. medicare.gov. Accessed October 22, 2021.

U.S. Government Website for Medicare. “Medicare Advantage Plans.” medicare.gov (accessed February 6, 2021).

Arizona Department of Economic Security. “Medicare Assistance.” des.az.gov (accessed February 6, 2021).

Official Website of the State of Arizona. “Arizona Department of Insurance and Financial Institutions.” insurance.az.gov (accessed February 6, 2021).