Written by Karin Klein

Reviewed by Diane Omdahl

Expert Reviewer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

What You Need to Know

- Medicare Supplement Plan D covers most out-of-pocket expenses except the Part B deductible and excess charges.

- It does not offer coverage for dental and vision care along with hearing aids and glasses.

- All Medicare Supplement Plan D policies cover the same expenses, no matter which health insurance company you choose.

After enrolling in Medicare Part A for hospitalization and adding Part B for doctor visits and outpatient care, there still will be expenses that aren’t covered. So it may be wise to consider adding supplemental or Medigap policies, sold by private insurance companies, to get the most coverage possible.

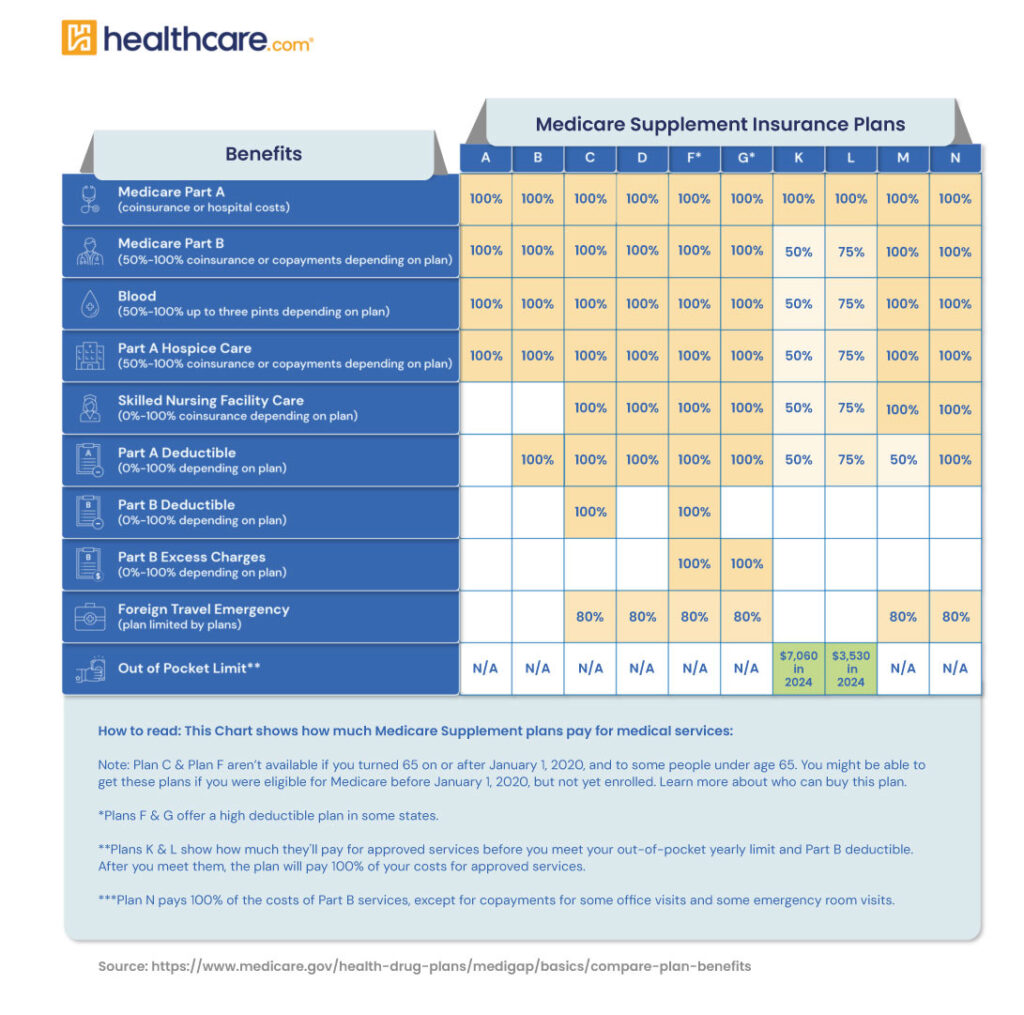

There are 10 different kinds of Medigap policies. But two of them, Medicare Supplement Plan C and Plan F, aren’t available for purchase by most people. Only people who were eligible before January 1, 2020, can buy this health insurance, which is the most comprehensive of the Medigap health coverage plans.

Don’t despair. Medicare Supplement Plan D is still available for those who want a policy with robust coverage, and this health plan covers most of what Plans C and F do. The main difference is that Plan D doesn’t cover the Part B deductible, which is $233 for the year 2022, and does not cover Part B excess charges.1 As with all Medigap policies, you can arrange for your coverage to start as soon as you are enrolled in Medicare Part A and Part B.

What’s the Difference Between Part D and Plan D?

Before going into what this health policy covers, it’s important to understand the difference between Medicare Supplement Plan D and Medicare Part D. Part D is not a Medigap policy, though it is purchased from private companies. It is coverage specific to prescription drugs. Supplement Plan D does not cover prescription drugs but does cover many medical bills that Part A and Part B don’t.

What Does Medicare Supplement Plan D Cover?

Among the expenses covered by Medicare Supplement Plan D, according to the U.S. government website for Medicare:

- Part A deductible.

- Part A coinsurance and hospitalization for an additional 365 days after Medicare benefits are used up.

- Part B coinsurance or copayment.

- The first three pints of any needed blood.

- Part A hospice care coinsurance or copayment.

- Skilled nursing facility care.

- Foreign travel emergency. The plan pays 80% of emergency medical expenses while out of the country after a $250 deductible.

Other plans also offer much of this coverage. But Plans A and B, for example, do not cover skilled nursing facility (SNF) care. Medicare Supplement Plan D is for people who want to cover as many contingencies as possible, including SNF care.

What Does Medicare Supplement Plan D Not Cover?

Some health expenses aren’t covered by any Medigap insurance. According to the U.S. government website for Medicare, these include:3

- Dental care.

- Routine vision care.

- Hearing aids.

- Eyeglasses.

What Does Medicare Supplement Plan D Cost?

Keep in mind that all Medicare Supplement Plan D policies cover the same expenses, no matter which health insurance company you choose. The same is true of all the Medigap policies. Those within the same letter cover the same expenses. All Plan Ds offer the same coverage as of the Plan Ds, all Plan Fs offer the same coverage as other Plan Fs. Yet the costs can vary quite a bit. Different companies often set different premiums even for identical coverage. Coverage in some states is more expensive than in others, as well.

When to Buy

The best time to buy Medicare Supplement Plan D is during your six-month Medigap Open Enrollment Period,

What Discounts Are Available for Medicare Supplement Plan D?

Some companies offer discounts for women, non-smokers or people who are married; others offer discounts for those who pay yearly, use electronic funds transfer, or buy multiple policies.

The states of Massachusetts, Minnesota and Wisconsin have their own ways of organizing Medigap coverage, so they must be checked separately. In Massachusetts, for example, three standard Medigap policies are available.2

Companies do not have to offer every supplement plan, so it might take some shopping around to find a Plan D policy if that’s what you choose. In addition, remember that you still would not be covered for prescription drugs, which would require purchasing Medicare Part D.

How Do You Enroll in Medicare Supplement Plan D?

As with all Medigap policies, the best time to buy Plan D health coverage without worrying about being rejected for coverage is during the six-month Medigap Open Enrollment Period, when you are 65 or older and enrolled in Medicare Part B for the first time. Your coverage can’t be canceled as long as you keep up your payments.

What Are Alternatives to Medicare Supplement Plan D?

What if you decide Medigap Plan D isn’t for you? If you are looking for similar levels of coverage but feel you don’t need quite as much as Plan D offers, you might want to consider Plan B, which covers nearly as much. The only difference is the lack of skilled nursing facility coverage and foreign travel emergency medical care.

You also could consider Medicare Advantage plans, which are not considered Medigap policies. With this coverage, a private provider contracts with the government to cover the usual Part A and Part B services, but also often covers additional services such as prescription drugs and vision care. Some even cover such services as transportation to the doctor’s office. The prices often are very competitive. But these plans might require you to receive care within a network of providers; health maintenance organizations and preferred provider groups frequently offer such plans.

If you want to read more on other Medigap policies, click this link to learn and compare them.

Thank you for your feedback!

Centers for Medicare & Medicaid Services. “2020 Medicare Parts A & B Premiums and Deductibles.” cms.gov (accessed May 2020).

“Medicare Supplement Plans Offered in Massachusetts 2020.” mass.gov (accessed May 2020).

U.S. Government Website for Medicare. “What’s Medicare Supplement Insurance (Medigap).” medicare.gov (accessed May 2020).

by

Diane Omdahl |

Updated on

August 29, 2025

by

Diane Omdahl |

Updated on

August 29, 2025