Written by Sharon O'Day

HealthCare Writer

Reviewed by Diane Omdahl

Expert Reviewer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

Explaining the Medicare Coverage Gap.

Additional plan options outside of Original Medicare (Parts A and B) coverage help limit unexpected healthcare costs. Your health at 65 might not predict future needs, and medical bills can quickly add up. This can be especially challenging on a fixed income, making supplemental insurance a valuable option.

Choosing My Type of Medicare Coverage

At 65, your primary decision is between Original Medicare and Medicare Advantage (Part C). Original Medicare covers most hospital and doctor expenses but does not include prescription drugs (which can be added with Medicare Part D). It offers flexibility with no network restrictions or referral requirements. However, there is no cap on out-of-pocket costs.

Medicare Advantage bundles hospital, doctor, and often drug coverage. It caps out-of-pocket expenses but restricts you to a network and usually requires referrals for specialists. It may also include dental and vision coverage.

What is Medicare Supplement Insurance?

Original Medicare doesn’t cover all costs. Medicare Supplement (also known as Medigap) helps manage out-of-pocket expenses like copayments, coinsurance, and deductibles. Offered by independent insurance companies, these policies supplement Original Medicare but do not add new coverage.

How Does Medicare Supplement Help?

Medicare Supplement plans work with Original Medicare to limit your exposure to unexpected medical costs. You decide the level of coverage and premium you prefer. To buy a policy, you must be enrolled in Medicare Part A and B. Medicare handles billing and claims with your insurance provider, simplifying the process.

Choices of Medicare Supplement Plans

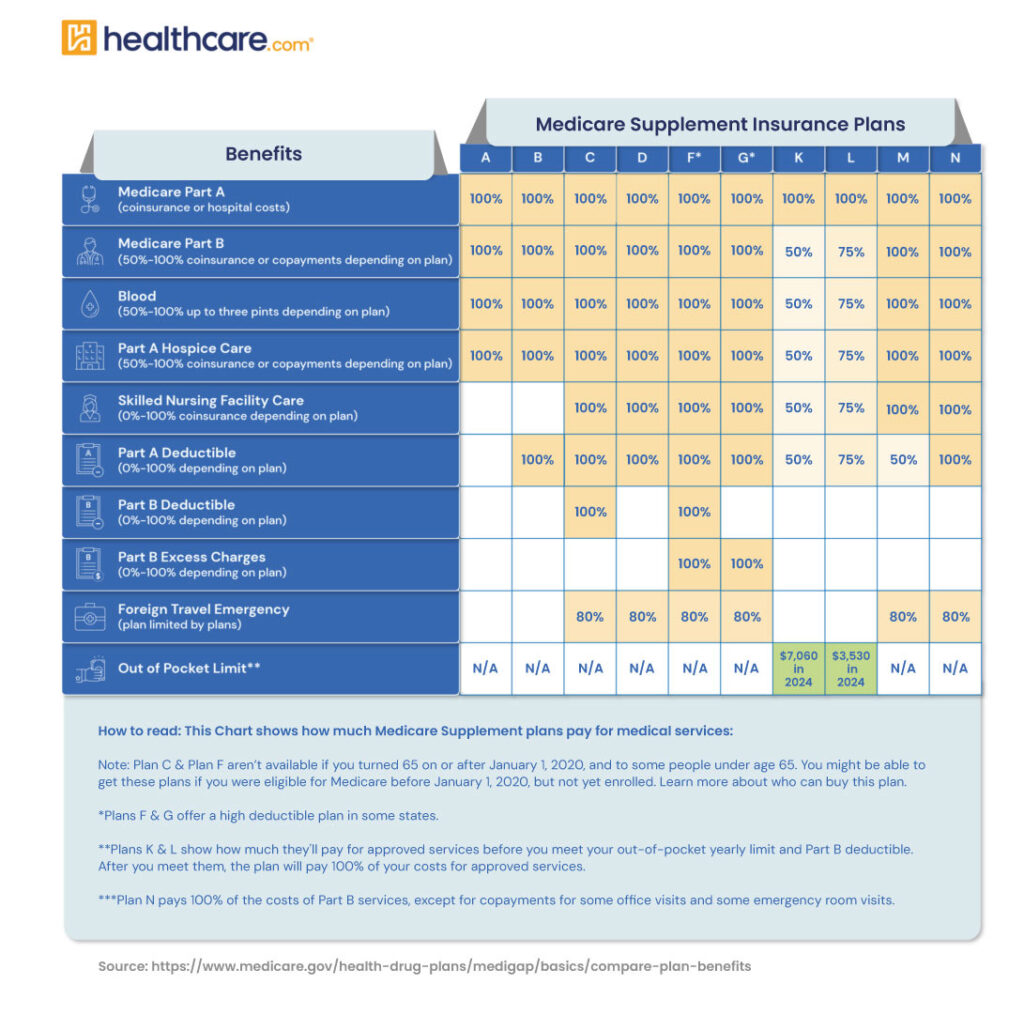

The federal government standardizes Medicare Supplement plans, ensuring consistent coverage regardless of the insurer. There are ten plans (A through N), but C and F are no longer available to new beneficiaries. Each plan covers different out-of-pocket costs, such as:

- Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits are used up.

- Part B coinsurance or copays.

- Blood (first 3 pints).

- Part A hospice care coinsurance or copays.

- Skilled nursing facility care coinsurance.

- Part A deductible.

- Part B deductible.

- Part B excess charge.

- Foreign travel emergency (up to plan limits).

- Above out-of-pocket limits.

What Medicare Supplement Plans Do Not Cover

These plans do not extend coverage beyond Original Medicare. They don’t cover dental, vision, hearing aids, private-duty nursing, or long-term care. Prescription drugs are not covered unless you have a separate Medicare Part D plan. Some plans cover foreign travel emergencies.

Why is Medicare Supplement Beneficial?

Original Medicare offers broad acceptance and no network restrictions, but to minimize out-of-pocket costs, a Medicare Supplement policy is beneficial. It ensures predictable expenses and comprehensive coverage.

Enrollment Period

The Open Enrollment Period lasts six months, starting when you are 65 or older and enrolled in Medicare Part B. During this time, you can’t be denied coverage or charged more due to medical conditions. Outside this period, you may face underwriting, potentially leading to higher costs or denial of coverage

You can buy a Medicare Supplement policy from any licensed insurer in your state. However, you can’t have both a Medicare Supplement policy and a Medicare Advantage plan. Availability varies by state.

Explaining the Medicare Coverage Gap: Is It for Me?

Original Medicare may not be the cheapest option, but it offers freedom in choosing healthcare providers. Adding Medicare Supplement to Original Medicare provides predictable out-of-pocket costs and comprehensive coverage. Medicare Advantage offers bundled services but comes with network restrictions and capped out-of-pocket costs. Assess your healthcare needs and financial situation to decide the best option for you.

Thank you for your feedback!

Centers for Medicare and Medicaid Services. “Medicare Enrollment Dashboard.” cms.gov (accessed November 2019); Kaiser Family Foundation. “An Overview of Medicare.” kff.org (published February 13, 2019).

U.S. Government Site for Medicare. “What’s Medicare Supplement Insurance (Medigap)?” medicare.gov (accessed January 10, 2020).

Centers for Medicare and Medicaid Services. “Medicare Parts A & B Premiums and Deductibles.” cms.gov (dated November 8, 2019).

U.S. Government Site for Medicare. “How to compare Medigap policies.” medicare.gov (accessed January 10, 2020).

by

Diane Omdahl |

Updated on

August 24, 2025

by

Diane Omdahl |

Updated on

August 24, 2025