Written by Tara Seboldt

HealthCare Writer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

What You Need to Know

- Medicare Supplement plans, also known as Medigap, help pay for out-of-pocket costs not covered by Medicare Part A and Part B.

- Indiana insurance companies must accept your Medicare Supplement (Medigap) plan application if you’re in your Medigap Open Enrollment Period or have guaranteed issue rights.

- The three most popular Medigap policies are typically Plans F, G, and N.

What Are Medicare Supplement Plans in Indiana?

Medicare is a federal health insurance program for individuals aged 65 and older, as well as younger people with qualifying disabilities or health conditions (e.g., end-stage renal disease).

Original Medicare includes Part A (Hospital Insurance) and Part B (Medical Insurance). While it covers many healthcare services, it still leaves you responsible for out-of-pocket expenses like deductibles, coinsurance, and copayments. Medicare Supplement plans help pay for these costs.

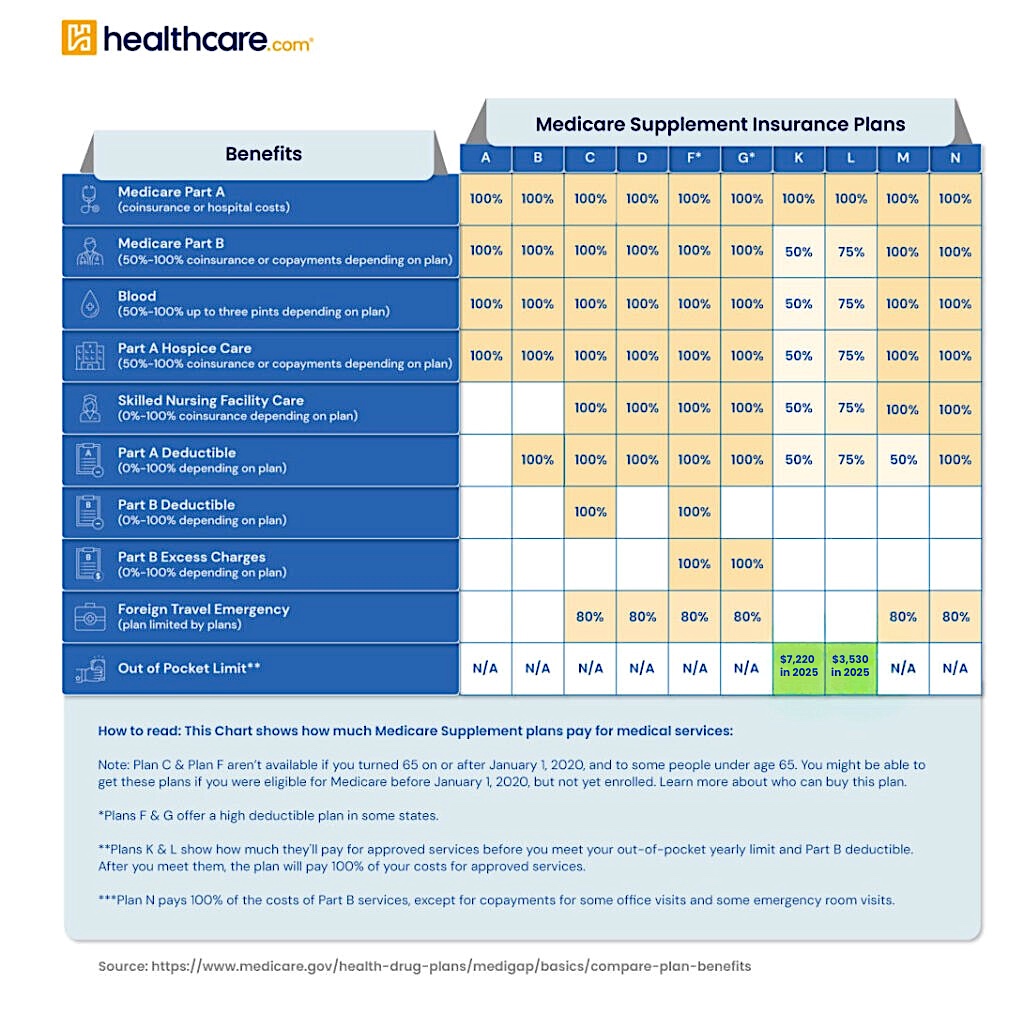

Medigap plans are standardized by letter (A through N). This means Plan A from one company offers the same benefits as Plan A from another—only the premiums and customer service may differ.

Learn how these plans work and how they benefit residents of Indiana.

When Can You Enroll in a Medicare Supplement (Medigap) Policy?

You can apply for a Medigap plan at any time. However, insurers may use your health history to deny coverage or charge higher premiums unless you’re in your Medigap Open Enrollment Period or have guaranteed issue rights.

Your Medigap Open Enrollment Period lasts for six months. It begins the month you are both age 65 (or older) and enrolled in Medicare Part B. During this window, insurers cannot deny you coverage or charge more based on your health status.

You may also qualify for guaranteed issue rights under certain circumstances—such as losing employer coverage or switching from a Medicare Advantage plan back to Original Medicare. In these cases, insurers must offer you a policy at standard rates.

Birthday Rule: Starting 1/1/2026, individuals can switch to the same Medicare supplement plan letter from any carrier without medical underwriting. Enrollment is within 60 days of their birthday, and coverage must begin the first of the month at least 30 days after signing.

Compare options HERE & start your health plan journey.

What Are the Most Popular Medicare Supplement Plans?

Across the U.S. and in Indiana, the most widely chosen Medigap plans are:

- Plan F: Offers the most comprehensive coverage but is only available to those eligible for Medicare before January 1, 2020.

- Plan G: Provides nearly the same coverage as Plan F, minus the Medicare Part B deductible.

- Plan N: Covers many costs but includes some copayments for doctor visits and emergency room care and does not cover Part B excess charges.

These three options are the most popular due to their robust coverage levels and predictable out-of-pocket costs.

How Do You Choose a Medicare Supplement Plan?

When selecting a Medigap plan in Indiana:

- Decide on a plan letter based on your budget and healthcare needs—Plans G and N are often good starting points.

- Compare the same plan across insurers. Plan benefits are standardized, but premiums can vary significantly.

- Understand pricing methods, which include:

- Attained age: Premiums increase with age.

- Issue age: Premiums are based on your age when you first buy the plan.

- Community rating: Premiums are the same for everyone, regardless of age.

Be sure to make “apples-to-apples” comparisons—e.g., Plan G from one insurer vs. Plan G from another.

How Much Do Medigap Policies Cost?

Medigap premiums in Indiana can vary based on:

- Your age and gender

- Tobacco use

- The plan letter you choose

- The pricing method the insurer uses

While the benefits are standardized, premium costs may differ across insurers, so it’s important to shop around.

Compare options HERE & start your health plan journey.

What If You Want to Change Your Medicare Supplement Plan?

You can apply to change Medigap policies at any time. However, unless you have guaranteed issue rights, insurers may use medical underwriting to determine your eligibility and pricing. This means they could deny your application or charge higher rates based on your health history.

If you’re considering switching plans, it’s wise to time the change around periods of eligibility or guaranteed issue rights when possible.

What Are Alternatives to Medicare Supplement Plans?

Medicare Advantage plans are a bundled alternative to Original Medicare. These plans are offered by private insurance companies and typically include:

- Part A (hospital insurance)

- Part B (medical insurance)

- Often include prescription drug coverage and may offer extras like dental, vision, hearing, and fitness programs

Instead of pairing Original Medicare with a Medigap and Part D plan, you can consider an all-in-one Medicare Advantage plan.

Learn more about Indiana Medicare Advantage plans.

Medicare Part D?

Medicare Part D plans provide standalone prescription drug coverage.

- Who needs it: People with Original Medicare who want drug coverage.

- What it covers: Prescription medications, with coverage varying by plan.

- How it’s offered: Through private insurers approved by Medicare.

- Not needed if: You have a Medicare Advantage plan with built-in drug coverage.

Shop for a Medicare plan with additional benefits!

Do Medigap Plans Cover Prescription Drugs?

No. Medicare Supplement (Medigap) plans do not include prescription drug coverage. If you need medication coverage, you’ll need to enroll in a separate Medicare Part D plan.

Medicare Resources in Indiana

Indiana residents can access several free resources for help navigating Medicare and Medigap:

- State Health Insurance Assistance Program (SHIP): Offers free one-on-one Medicare counseling to Indiana residents.

- Indiana Department of Insurance: Oversees insurance providers and handles consumer complaints related to Medigap plans.

- Indiana Medicaid: Provides healthcare coverage to low-income seniors and may coordinate with Medicare. Eligibility is based on income and other criteria.

Next Steps

If you think a Medicare Supplement plan in Indiana is the right fit for you, begin by comparing plan types and insurers in your area. You can browse plans online or speak with a licensed insurance agent for expert guidance.

Don’t forget to explore Medicare Part D or Medicare Advantage options if you want drug coverage or all-in-one plan convenience.

Thank you for your feedback!

U.S. Government Website for Medicare. When can I buy Medigap? medicare.gov. Accessed March 24, 2021.

U.S. Government Website for Medicare. Guaranteed issue rights. medicare.gov. Accessed March 24, 2021.

America’s Health Insurance Plans. State of Medigap 2020. ahip.org. Accessed March 24, 2021.

U.S. Government Website for Medicare. Cost of Medigap policies. medicare.gov. Accessed March 24, 2021.

U.S. Government Website for Medicare. Find a Medigap policy that works for you. medicare.gov. Accessed March 24, 2021.