Written by Paige Cerulli

HealthCare Writer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

What You Need to Know

- Medicare Supplement plans, also known as Medigap, help pay for out-of-pocket costs not covered by Medicare Part A and Part B.

- North Carolina insurance companies must accept your Medicare Supplement (Medigap) plan application if you’re in your Medigap Open Enrollment Period or have guaranteed issue rights.

- The three most popular Medigap policies are typically Plans F, G, and N.

What Are Medicare Supplement Plans in North Carolina?

Medicare is a federal health insurance program for individuals aged 65 and older, as well as for younger people with qualifying disabilities or health conditions such as end-stage renal disease.

Original Medicare includes Part A (Hospital Insurance) and Part B (Medical Insurance), but it doesn’t cover all costs. Beneficiaries are still responsible for expenses such as deductibles, copayments, and coinsurance. Medicare Supplement plans, also known as Medigap, help cover these out-of-pocket costs.

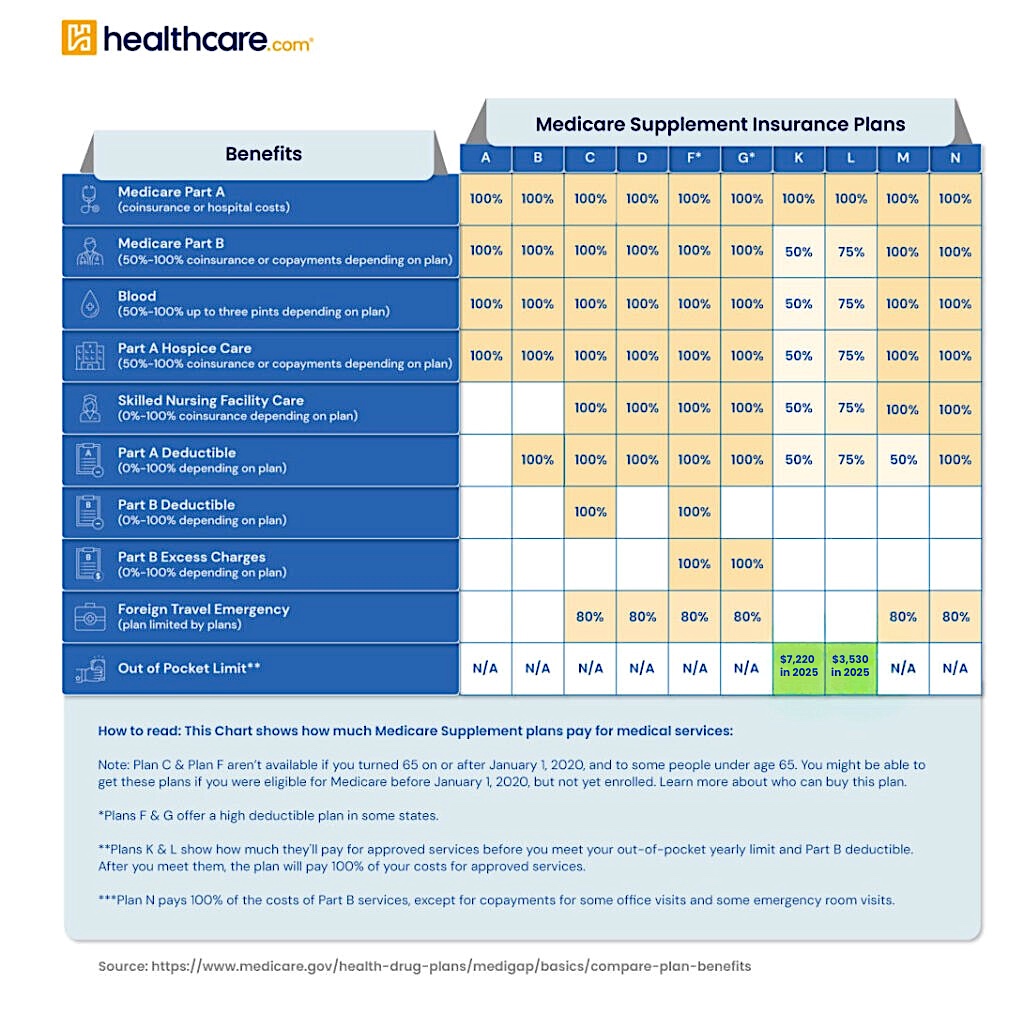

Medigap plans are standardized and labeled by letter (Plans A through N), meaning the benefits of each plan letter are the same no matter which insurance company offers them—though premiums can vary. Learn how these plans work and how they benefit residents of North Carolina.

Compare options HERE & start your health plan journey.

When Can You Enroll in a Medicare Supplement (Medigap) Policy?

You can apply for a Medigap plan at any time. However, insurance companies may use your health history to deny coverage or charge higher premiums if you apply outside of your Medigap Open Enrollment Period and don’t have guaranteed issue rights.

Your Medigap Open Enrollment Period lasts for six months. It begins the month you are both 65 or older and enrolled in Medicare Part B. During this time, insurers must offer you any plan they sell at their standard rates, regardless of your health status.

This is the ideal time to enroll, as it gives you access to the most options and the best rates.

You may also qualify for guaranteed issue rights due to certain life events, such as losing other health coverage or moving out of a Medicare Advantage plan’s service area. If you qualify, insurers cannot deny you coverage or charge more based on your health.

What Are the Most Popular Medicare Supplement Plans?

The most commonly selected Medigap plans in North Carolina include:

- Plan F – Offers the most comprehensive coverage, including nearly all out-of-pocket costs. However, it’s only available to people who became eligible for Medicare before January 1, 2020.

- Plan G – Provides robust coverage, similar to Plan F, but does not cover the Medicare Part B deductible.

- Plan N – Offers solid coverage but requires copayments for some doctor and emergency room visits and does not cover Part B excess charges.

North Carolina residents can also choose high-deductible versions of Plans F and G, which offer lower premiums in exchange for a higher deductible.

How Do You Choose a Medicare Supplement Plan?

To choose the right Medigap plan:

- Decide which plan letter suits your healthcare needs and budget (e.g., G or N).

- Compare plans using online tools or consult a licensed insurance agent for help.

- Look at premiums from different insurers for the same plan letter—benefits are standardized, but pricing can vary based on:

- Attained age rating: Premiums increase as you age.

- Issue age rating: Premiums are based on the age you are when you first buy the policy.

- Community rating: Everyone pays the same premium regardless of age.

Always compare the same plan type across multiple insurers to ensure you’re getting the best value.

How Much Do Medigap Policies Cost?

Medigap premiums in North Carolina vary depending on several factors, including:

- Your age and gender

- Whether you use tobacco

- The plan type you choose

- The insurer’s pricing method (attained age, issue age, or community rating)

While premiums differ, the benefits for each plan letter are the same no matter which insurer you choose.

Compare options HERE & start your health plan journey.

What If You Want to Change Your Medicare Supplement Plan?

You can apply to switch Medigap policies at any time. However, unless you have guaranteed issue rights, insurance companies may evaluate your health and could deny your application or charge higher premiums based on your health status.

That’s why it’s important to choose carefully during your initial Medigap Open Enrollment Period.

What Are Alternatives to Medicare Supplement Plans?

Medicare Advantage plans, also known as Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and typically include:

- Part A (Hospital Insurance)

- Part B (Medical Insurance)

- Most include Part D (prescription drug coverage)

Medicare Advantage plans often bundle in extra benefits such as dental, vision, hearing, and wellness programs. Instead of combining a Medigap and a Part D plan, you may opt for the convenience of an all-in-one Medicare Advantage plan.

Learn more about North Carolina Medicare Advantage plans.

Medicare Part D

Medicare Part D plans offer standalone prescription drug coverage.

- Who needs it: If you have Original Medicare and want drug coverage, you’ll need to buy a Part D plan.

- What it covers: Prescription medications (coverage and costs vary by plan).

- How it’s offered: Through private insurance companies approved by Medicare.

- Not needed if: You have a Medicare Advantage plan that includes drug coverage (MAPD).

Shop for a Medicare plan with additional benefits!

Do Medigap Plans Cover Prescription Drugs?

No, Medigap plans do not cover prescription drugs. You’ll need a separate Medicare Part D plan for medication coverage if you choose to stay with Original Medicare and Medigap.

Medicare Resources in North Carolina

If you need help navigating Medicare or choosing a Medigap plan in North Carolina, the following resources can assist:

- North Carolina Seniors’ Health Insurance Information Program (SHIIP) – Offers free, one-on-one Medicare counseling to state residents.

- North Carolina Department of Insurance – Oversees Medigap insurers and helps with complaints and appeals.

- North Carolina Medicaid Program – Provides healthcare coverage for low-income residents and works with Medicare in some cases.

Next Steps

If a Medicare Supplement plan in North Carolina fits your needs, take the next step by comparing plans available in your area. You can explore options online or connect with a licensed insurance agent for personalized support.

Thank you for your feedback!

Medicare.gov. “What’s Medicare Supplement Insurance (Medigap)?” medicare.gov. (accessed September 10, 2020).

Medicare.gov. “What’s Medicare Supplement Insurance (Medigap)?” medicare.gov.

Medicare.gov. “What’s Medicare Supplement Insurance (Medigap)?” medicare.gov.

Medicare.gov. “Find a Medicare Plan.” medicare.gov. (accessed September 10, 2020).

Medicare.gov. Medicare. “When Can I Buy Medigap?” medicare.gov. (accessed September 10, 2020).

Medicare.gov. “Guaranteed Issue Rights.” medicare.gov. (accessed September 10, 2020).

Medicare.gov. “Special Circumstances (Special Enrollment Periods).” medicare.gov. (accessed September 10, 2020).

Medicare.gov. “Benefits Offered by Each Medigap Plan.” medicare.gov. (accessed September 10, 2020).

Medicare.gov. “Find a Medicare Plan.” medicare.gov.

Medicare.gov. “Find a Medicare Plan.” medicare.gov.

Medicare.gov. “Switching Medigap Policies.” medicare.gov (accessed September 10, 2020).

Medicare.gov. “Medicare Advantage Plans.” medicare.gov (accessed September 10, 2020).