Medicare Eligibility Calculator

Let us help you by providing important information about Medicare.

You may be eligible for Medicare sooner if you qualify due to a disability, amyotrophic lateral sclerosis (ALS) or end-stage renal disease (ESRD). Check with your local Social Security office or visit ssa.gov for more information.

Approaching age 65? Use this Medicare Enrollment Calculator to precisely calculate your Initial Enrollment Period – the 7-month window to enroll in Part A and Part B without incurring penalties.

Simply enter your birth date and navigate your Medicare enrollment easily and accurately.

Explore all of the Medicare plan options:

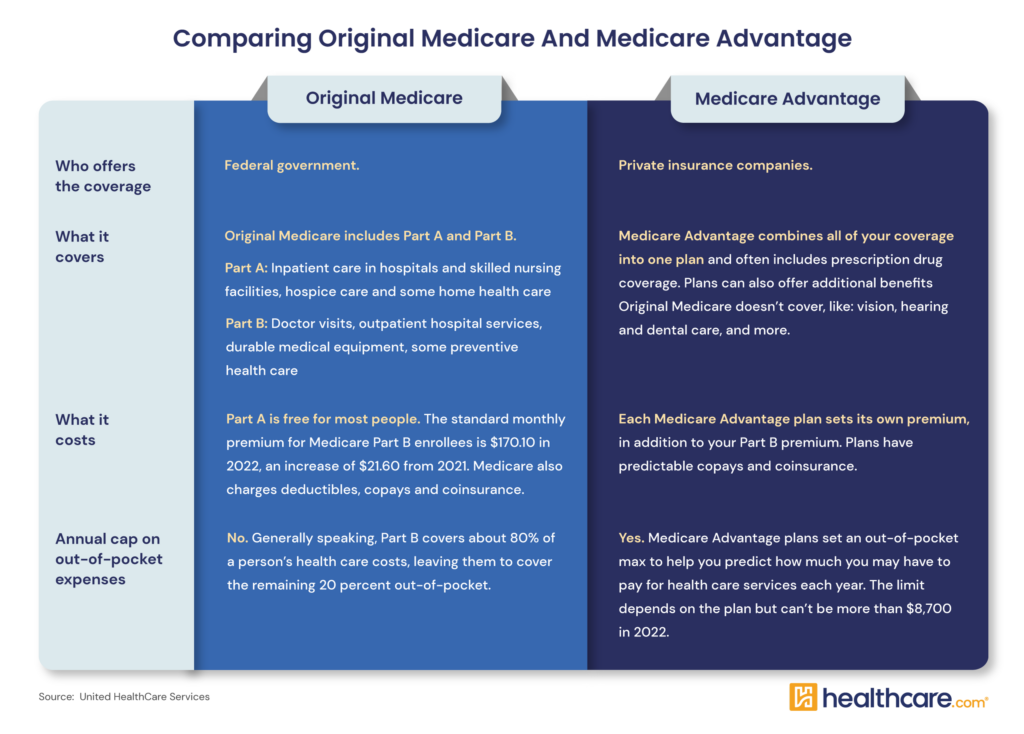

Original Medicare Part A (Hospital Insurance)

- Inpatient care in hospitals

- Skilled nursing facility care

- Hospice care

- Home health care

Original Medicare Part B (Medical Insurance)

- Services from doctors and other healthcare providers

- Outpatient care

- Home health care

- Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Many preventive services (like screenings, shots or vaccines, and yearly “Wellness” visits)

Part C (Privately owned Medicare also known as Medicare Advantage)

- Alternative to Original Medicare for your health coverage.

- Everything covered by Parts A and B;

- HMO or PPO networks may be available;

- Possibly additional benefits or services.

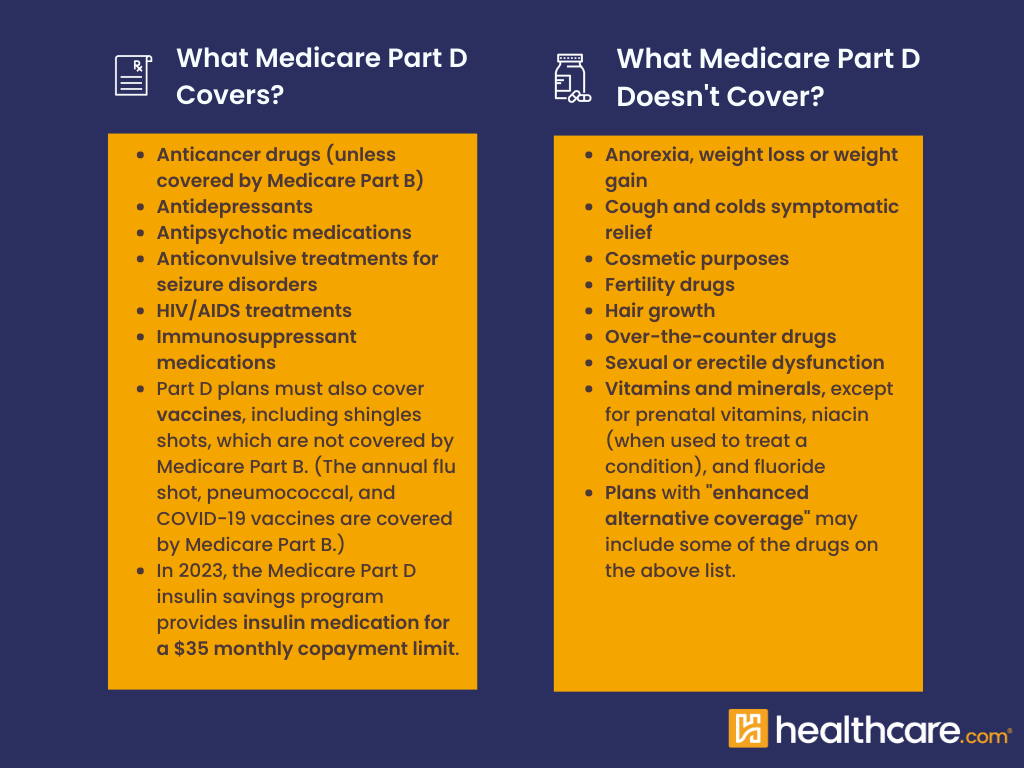

- Helps cover the cost of prescription drugs (including many recommended shots or vaccines).

- Plans that offer Medicare drug coverage (Part D) are run by private insurance companies that follow the rules set by Medicare.

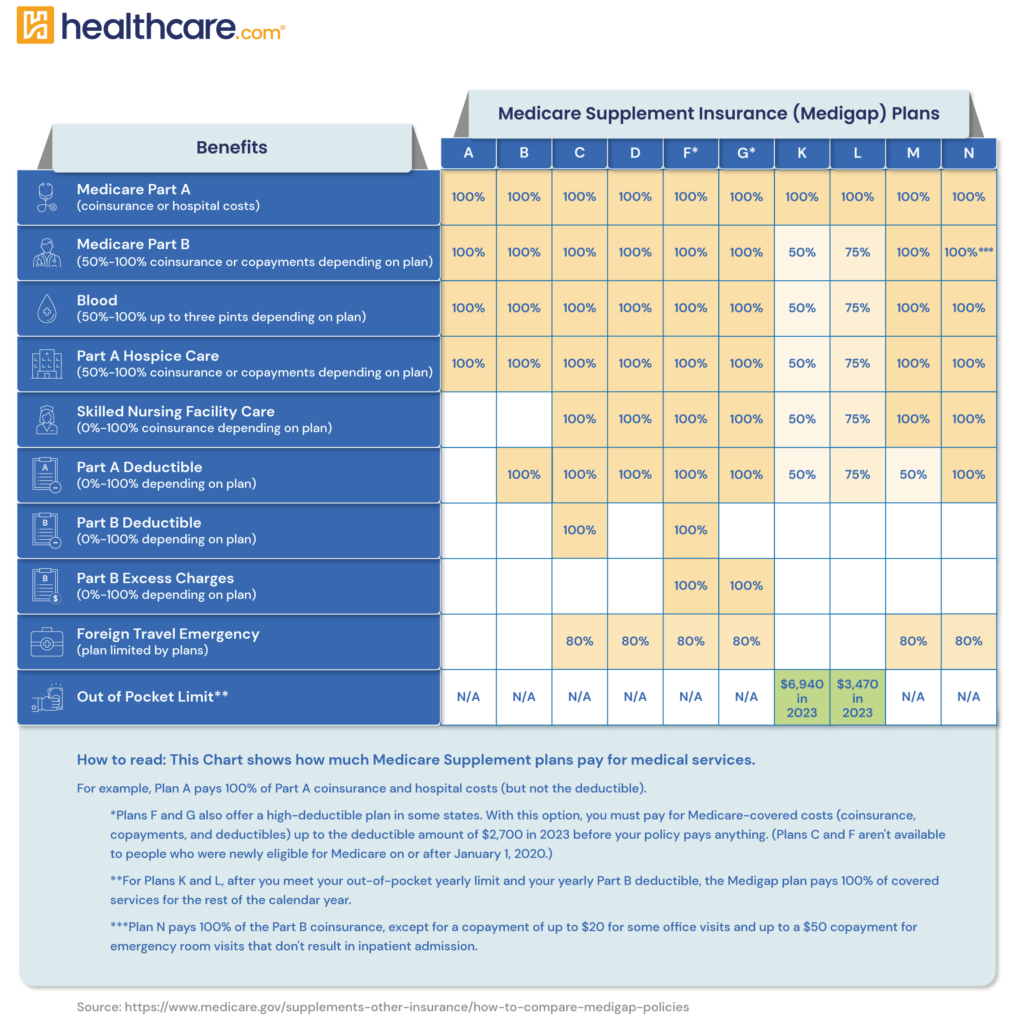

- Medicare Supplement insurance or Medigap plans (Plans A-N) are sold by private insurance companies to fill “gaps” in Original Medicare (Parts A and B) coverage, including expenses like deductibles, copays, and coinsurance.