Written by Michael LaPick

Healthcare Writer

We aim to help you make informed healthcare decisions. While this post may contain links to lead generation forms, this won’t influence our writing. We follow strict editorial standards to give you the most accurate and unbiased information.

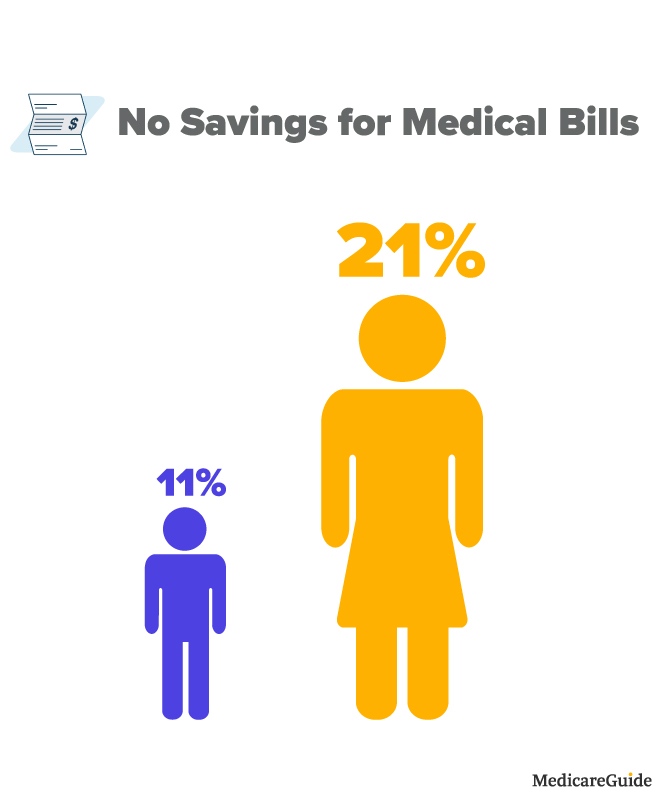

Women face headwinds paying for healthcare in their golden years.

21% of 65+ women have no savings for medical bills, compared to 11% of men.

MedicareGuide Annual Health Finance Survey

American women face significant headwinds paying for healthcare in their golden years compared to men.

A new survey shows that twice as many older American women as men lack savings for medical bills.

21% of older women report zero savings for medical bills, compared to just 11% of older men.

Older American women are also more likely to feel troubled about their ability to pay for medical care.

Six in ten (61%) say they are very or somewhat concerned about their ability to pay for healthcare costs, compared to half of men (52%).

Women aged 65+ worry about what could happen if they were to experience a medical emergency.

51% of women are very or somewhat concerned a major health situation could lead to bankruptcy or debt, compared to 40% of men.

When actually facing healthcare bills, 30% of older women have trouble paying compared to 24% of men.

Men are also more likely to hold a significant nest egg for healthcare.

41% of men aged 65 and up have more than $6,000 in savings for medical bills, compared to 28% of women in the same age bracket.

MedicareGuide surveyed 1,176 U.S. adults aged 65 and up ahead of this year’s Medicare Annual Enrollment Period.

65+ Healthcare Gender Divide

Women and men experience a different array of healthcare costs.

Both women and men rank long-term care as their number one expense, at roughly a quarter (24%) of respondents for each gender.

But almost the same ratio of women, 24%, say health insurance is their top expense, compared to 19% of men.

Meanwhile, 22% of older women rank dentist bills as their largest healthcare expense compared to 14% of men.

And 10% of women rank doctor bills their highest medical cost compared to 5% of men.

Men, on the other hand, are more likely to cite inpatient hospital bills as their top expense (13% compared to 10% of women).

Women 65 and up are also more prone to skipping expenses and purchases in order to afford healthcare.

32% of women told MedicareGuide they had foregone paying for expenses and purchases to afford medical costs, compared to 23% of men.

Among the items older women are most likely to skip than men: food, big-ticket purchases and home repair.

By a 28% to 24% ratio when compared with men, older women are also deferring medical treatments.

Even in the years before they qualify for Medicare, women have more trouble paying for healthcare.

39% of women aged 60-65 find it difficult or very difficult to pay for healthcare, compared to 33% of men.

Methodology: MedicareGuide conducted this survey utilizing a SurveyMonkey Audience on September 13-16, 2021, among a national sample of 1,176 U.S. adults aged 65+. The modeled error estimate for this survey is plus or minus 2.0 percentage points. The sample was balanced for age, gender, and U.S. Region according to the Census Bureau’s American Community Survey.

Thank you for your feedback!